TL;DR

- BlackRock has expanded its tokenized BUIDL fund, initially launched on Ethereum, to include new blockchains such as Aptos, Arbitrum, Avalanche, Optimism, and Polygon.

- The expansion allows more investors, DAOs, and digital asset companies to interact with BUIDL, offering on-chain yields, dividends, and near real-time transfers.

- BUIDL, which reached $517 million in assets under management in less than 40 days, has consolidated itself as the leading fund in the tokenized government securities sector.

BlackRock has expanded its tokenized USD Institutional Digital Liquidity Fund (BUIDL), which was initially launched on the Ethereum blockchain. From now on, the fund will be available on new blockchain networks such as Aptos, Arbitrum, Avalanche, Optimism, and Polygon.

BlackRock’s initiative opens the door for a larger number of investors, decentralized autonomous organizations (DAOs), and digital asset-based companies to interact directly with BUIDL, taking advantage of the benefits of each ecosystem. According to Securitize, the company responsible for tokenizing the fund, each new blockchain will allow users to access on-chain yields, dividends, and make peer-to-peer transfers almost in real-time, increasing custody flexibility and transaction efficiency.

BlackRock Creates the Largest Tokenized Fund

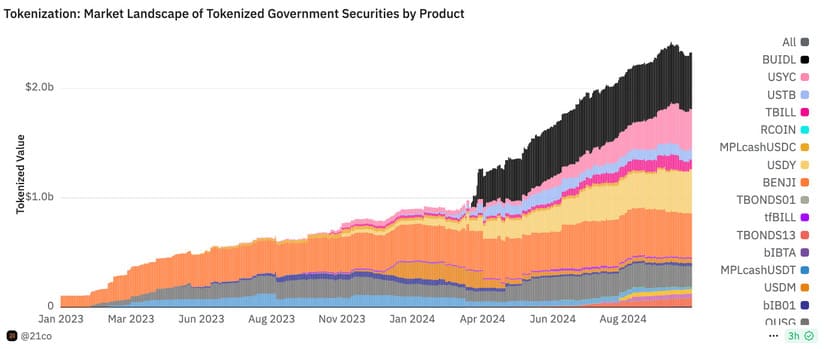

BUIDL has experienced meteoric growth since its launch, becoming the largest tokenized fund in less than 40 days. Currently, it manages around $517 million in assets, granting it a 22% market share in the tokenized government securities market, which is valued at $2.3 billion in total. BUIDL has positioned itself as the leader in its sector, surpassing even other major funds, such as Franklin Templeton’s BENJI fund, which manages $403 million.

New Capabilities

With this new offering, BlackRock plans to take asset tokenization to new levels, providing investors with access to various platforms and increasing the potential of decentralized finance. According to Carlos Domingo, CEO of Securitize, real-world asset tokenization is scaling, and the addition of these new blockchains will expand the fund’s capabilities, allowing investors to leverage technology that improves efficiency in areas that have traditionally been difficult to optimize.

Furthermore, BNY will continue to serve as the administrator and custodian of BUIDL both on Ethereum and on the new blockchains, ensuring that the fund maintains its ability to operate in various traditional and digital financial ecosystems