Key Takeaways

- MicroStrategy’s Bitcoin holdings have generated over $10 billion in unrealized gains.

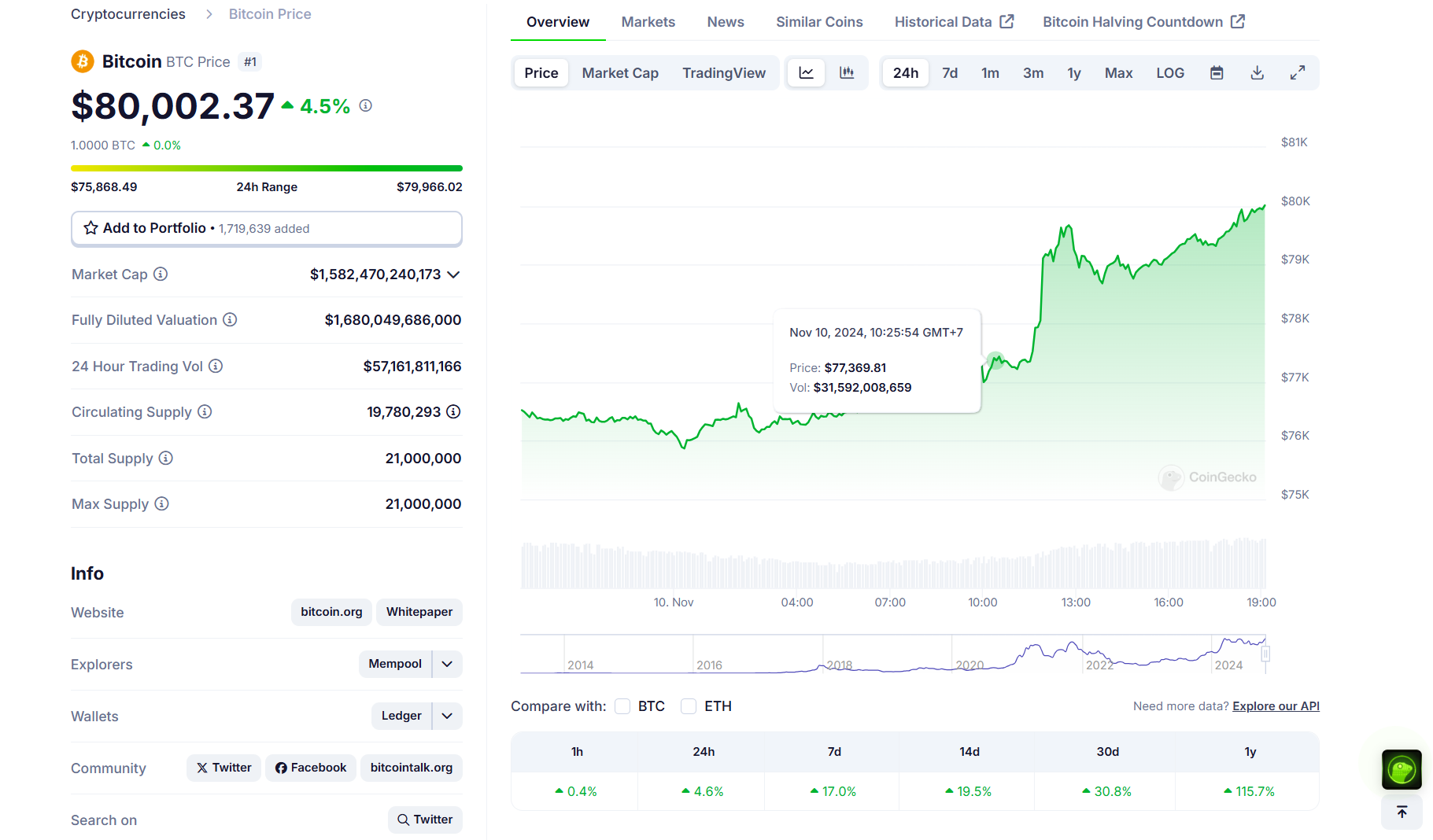

- Bitcoin’s price increase to $80,000 coincided with Trump’s reelection and global monetary adjustments.

Share this article

MicroStrategy’s Bitcoin holdings have surged to over $20 billion in value, generating more than $10 billion in unrealized gains as Bitcoin’s price topped $80,000 today, according to data tracked by its portfolio.

The company, headed by Bitcoin advocate Michael Saylor, has accumulated 252,220 Bitcoin since its initial purchase in 2020, with an average acquisition cost of around $39,200 per Bitcoin, translating to a total investment cost of around $9.9 billion.

MicroStrategy’s unrealized gains have skyrocketed amid Bitcoin’s price rally. Bitcoin reached $77,000 following Donald Trump’s election victory and the Fed’s interest rate decision, before soaring to $80,000 earlier today, according to CoinGecko data.

At the time of reporting, BTC was trading at around $79,700, up over 4% in the last 24 hours and roughly 118% year-to-date.

Trump’s reelection as US president has sparked optimism about favorable crypto regulations. He has demonstrated support for digital assets by participating in industry events, including the Bitcoin 2024 Conference.

Recent monetary policy shifts have also contributed to the rally, with both the US Fed and Bank of England implementing 25 basis point rate cuts on Thursday.

The broader crypto market has benefited from Bitcoin’s momentum, with Ethereum rising over 5%, Solana gaining 2%, and Dogecoin jumping 14%. The total crypto market cap has soared to $2.8 trillion, up over 3% over the past 24 hours.

MicroStrategy’s stock surges nearly 330% this year

Not only has MicroStrategy’s Bitcoin bet yielded massive gains, but its stock performance has also risen.

Bitcoin’s rally recently lifted MicroStrategy’s stock to $270, its highest level in 25 years, data from Yahoo Finance shows. The stock has increased approximately 330% year-to-date.

With a focus on increasing shareholder value through digital asset management and leveraging capital markets, MicroStrategy aims to continue expanding its Bitcoin reserves and enhancing overall profitability in the coming years.

According to its Q3 earnings report, MicroStrategy plans to raise $42 billion over the next three years, split evenly between equity and fixed-income securities to finance further Bitcoin purchases.

Share this article