TL;DR

- Trump’s 2024 victory could bring a pro-crypto administration and a less restrictive stance from the SEC towards the digital asset market.

- Pro-crypto candidates like Bernie Moreno and Ritchie Torres won in their districts, indicating the growing influence of crypto voters.

- Gary Gensler is expected to be removed from his position at the SEC, and the regulator could resolve ongoing conflicts with Ripple.

Donald Trump’s recent victory in the 2024 U.S. presidential election marks a turning point for the future of the crypto market.

The crypto industry anticipates that his administration will promote a more favorable stance toward digital assets. Trump has promised to make changes within the Securities and Exchange Commission (SEC), an institution that has historically maintained a highly adversarial position toward the sector.

Goodbye, Gary Gensler

The president-elect has specifically expressed his intention to dismiss Gary Gensler, the current SEC chair, whose strict regulatory policies have led to numerous lawsuits against major players like Coinbase, Ripple, and Kraken. This shift in administration could bring greater regulatory clarity and a less restrictive approach to the crypto ecosystem.

To everyone who doubted it:

the crypto voter is here to stay, loud and clear!Truly amazing to see crypto champions like @berniemoreno, @RitchieTorresNY, @gillibrandny and @RepAndyBarr get the W with this election.

— Brad Garlinghouse (@bgarlinghouse) November 6, 2024

Alongside Trump’s election, other pro-crypto candidates, such as Bernie Moreno in Ohio and Ritchie Torres in New York, have won in their respective districts, demonstrating the growing power of voters interested in the crypto industry.

The Crypto Industry Celebrates Donald Trump’s Victory

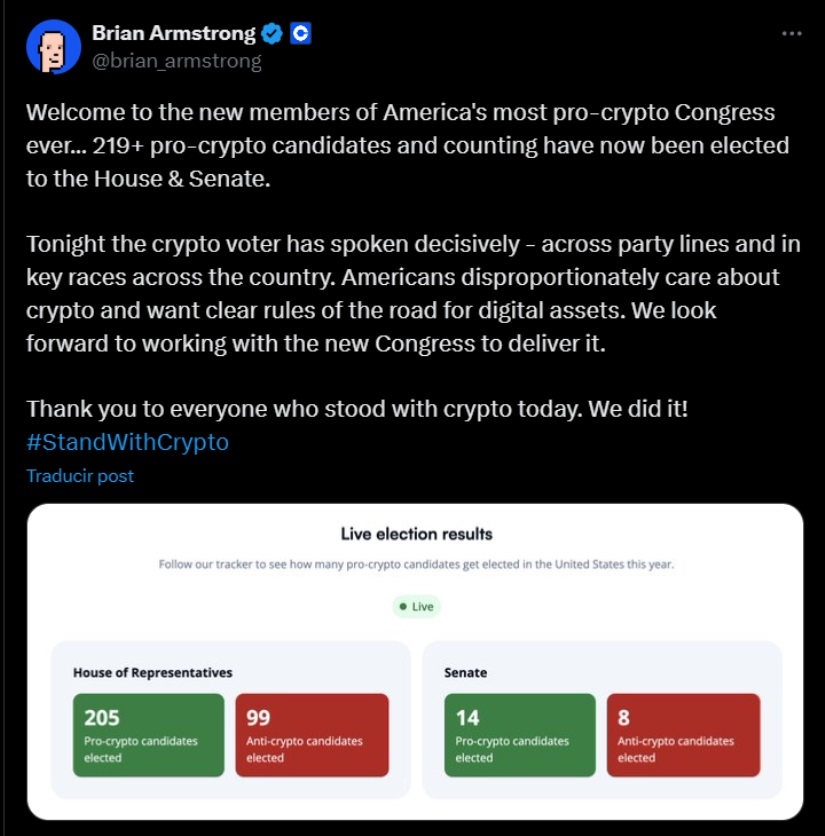

This outcome has been celebrated by industry figures, who see in this victory an opportunity to solidify more crypto-friendly policies. Brian Armstrong, CEO of Coinbase, highlighted that this is “the most pro-crypto Congress in history,” noting that voters have voiced their support for clear regulation in the sector. Similarly, Brad Garlinghouse, CEO of Ripple, stated on social media that “the crypto voter is here to stay, loud and clear.”

A Positive Horizon for Ripple?

The potential shift in the SEC’s approach has also raised hopes for a favorable resolution in the lawsuit the agency has ongoing against Ripple, which could conclude under Trump’s administration, providing a critical regulatory precedent for the sector. At the same time, increasing institutional demand for XRP could lead to the launch of an exchange-traded fund (ETF) based on this cryptocurrency, boosting its adoption in traditional markets.

Additionally, the price of Bitcoin reached a new all-time high, driven by the prospect of an administration that may ease regulations and encourage crypto adoption. As of the time of this article, BTC is trading around $73,900, a slight correction after peaking at $75,361