Intense outflows from Bitcoin ETFs spark concern as financial markets anticipate political and economic shifts.

Key Takeaways

- US spot Bitcoin ETFs saw one of their largest single-day outflows on November 4.

- Bitcoin’s price fell below $70,000 coinciding with massive ETF outflows.

Share this article

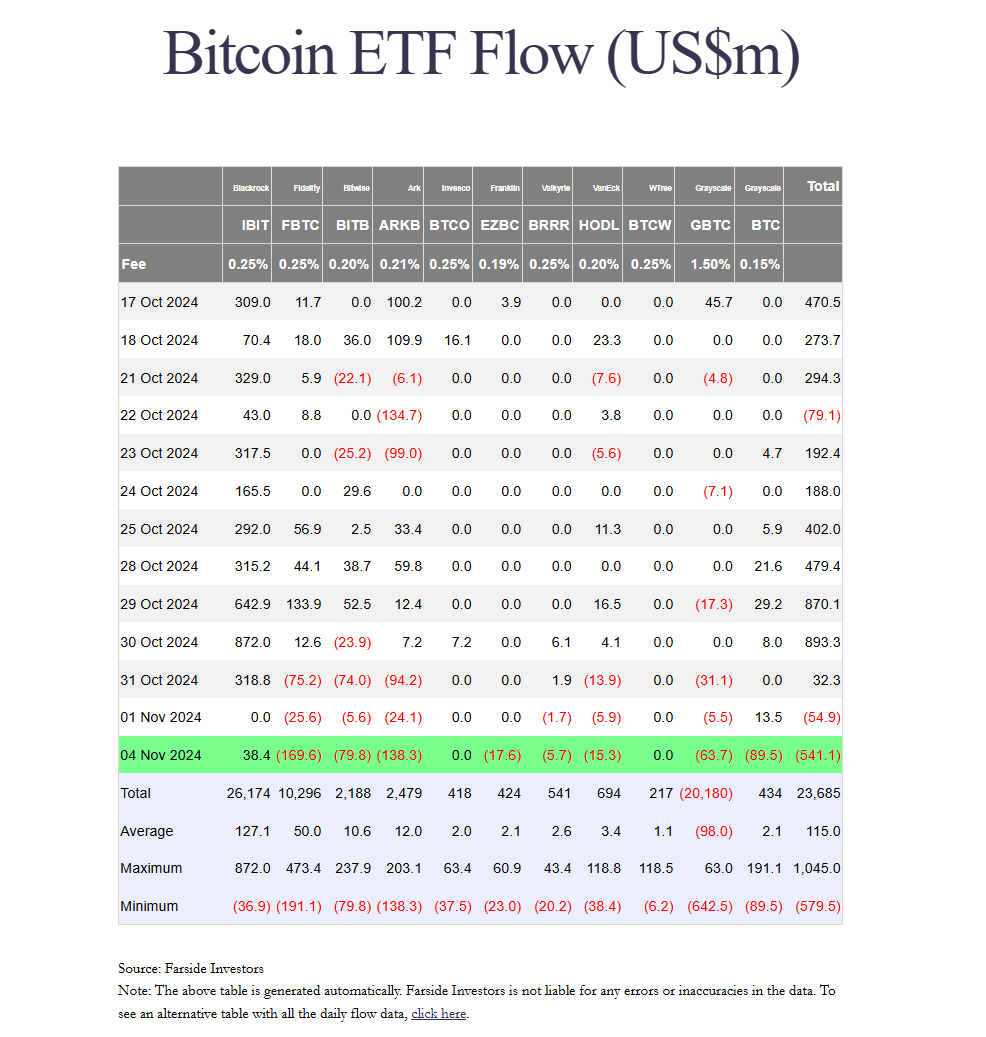

US spot Bitcoin ETFs suffered their second-largest single-day outflow since launch, with investors withdrawing $541 million on November 4, according to data from Farside Investors.

The selloff just trailed behind the record of $563 million set on May 1, with Fidelity’s FBTC experiencing the heaviest withdrawals at $170 million on Monday, its second-biggest daily outflow to date.

Ark Invest’s ARKB and Bitwise’s BITB posted their worst performances since inception, with outflows of $138 million and $80 million respectively. Grayscale’s BTC saw $89 million in withdrawals, while its GBTC fund lost $64 million.

Franklin Templeton, VanEck, and Valkyrie funds collectively recorded outflows exceeding $38 million.

In contrast, BlackRock’s IBIT reported around $38 million in net inflows while WisdomTree’s BTCW, and Invesco’s BTCO reported no flows.

Spot Bitcoin ETFs snapped their seven-day winning streak last Friday as Bitcoin dropped below $70,000 after trading near its all-time high earlier that week, per CoinGecko.

The largest crypto asset extended its slide over the weekend, falling to a low of $67,300. However, it still maintains its gains since the US Fed made an aggressive 50 basis-point cut on September 18.

Markets brace for volatility ahead of Election Day and the FOMC meeting

All eyes are now on tomorrow’s presidential election and the Fed policy decision scheduled for Wednesday. Crypto markets brace for more volatility ahead of these key events.

Analysts predict heightened volatility in Bitcoin as the election approaches. This is likely to trigger a “sell-the-news” reaction, similar to past events where market participants reacted strongly to major news, leading to price fluctuations.

Bitcoin is currently trading at around $67,800, down 2% in the last 24 hours, CoinGecko data shows. The total crypto market cap also dropped almost 3% to $2.3 trillion.

As Bitcoin sneezes, the broader crypto market catches a cold. Ethereum and Solana dipped over 3% each, while Toncoin and Chainlink dropped 5%, respectively.

Historically, Bitcoin has shown notable price increases following US elections. For example, after the 2012, 2016, and 2020 elections, Bitcoin’s price saw substantial gains in the year following each election cycle. This trend suggests the potential for Bitcoin to rally post-election, regardless of which candidate wins.

However, short-term price actions may depend on who wins the election. Bernstein analysts suggest that a Trump victory could propel Bitcoin’s price to $90,000. In contrast, if Harris wins, Bitcoin could crash to $50,000.

Share this article