Following the Federal Reserve’s decision to cut interest rates in September, Bitcoin has been volatile yet predominantly bullish. Analysts and investors are now waiting patiently for the next leg up, as BTC recently stopped at the $69,400 mark and is finding strong support around $66,000. This level is key, as it could determine Bitcoin’s next price movement.

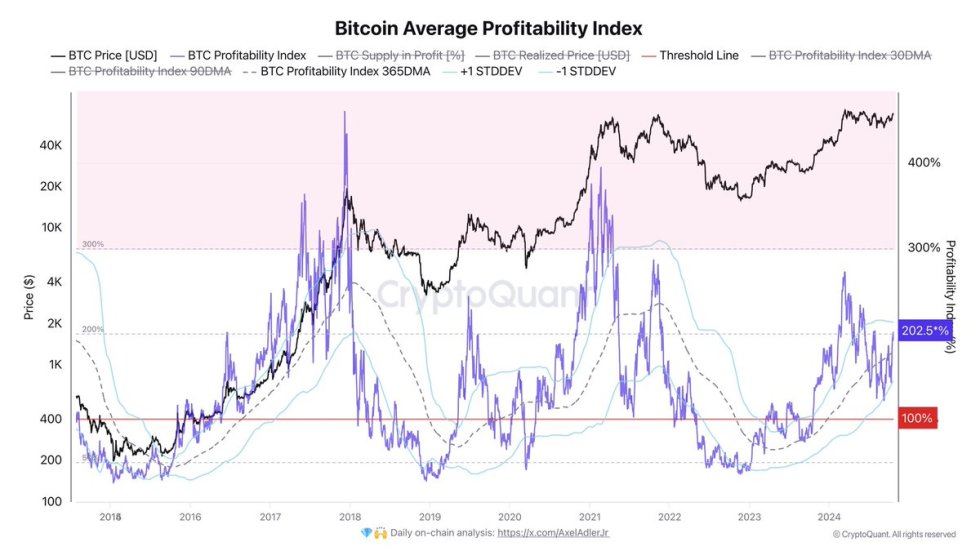

Key data from CryptoQuant reveals that the Bitcoin Average Profitability Index is currently at 202%, indicating that the price is roughly twice the realized price. This metric provides confidence to investors and traders who expect Bitcoin to continue rising.

With profitability still well below levels that typically trigger mass profit-taking, it suggests more room for BTC to grow before significant selling pressure emerges.

Many believe the coming weeks will be crucial, as Bitcoin’s strength above $66,000 could pave the way for a breakout above $70,000, while failure to hold this support might result in a deeper retrace.

Bitcoin Investors Waiting For A Rally

CryptoQuant data shared by on-chain analyst Axel Adler reveals insights into Bitcoin’s current market conditions but may not dictate immediate price action in the coming days. As investors remain hopeful that BTC will continue rising and challenge all-time highs, Adler highlighted the Bitcoin Average Profitability Index on X.

This index serves as a crucial indicator of market sentiment, suggesting that when it surpasses 300%, it often prompts investors to start actively taking profits.

The index sits at 202%, indicating that we may be halfway to that critical threshold. This suggests that while there is still significant room for price appreciation, we are approaching a point where profit-taking may become prevalent.

Once the Average Profitability Index hits the 300% mark, selling pressure could intensify enough to trigger a correction event, potentially pushing the price down.

However, it’s essential to note that average profitability remains relatively low compared to previous cycle tops. This context implies that, despite the potential for increased selling pressure, the current market sentiment may not lead to a drastic downturn, as many investors still find value in holding their positions.

Overall, while Adler’s analysis provides valuable insights into potential market behavior, the future price movement of Bitcoin will depend on broader market dynamics and investor sentiment as they navigate this evolving landscape.

BTC Holding Above Key Demand Level

Bitcoin (BTC) is currently trading at $66,400 after facing a rejection from the $69,400 supply level. The price remains strong, holding above the critical $66,000 mark, which will play a pivotal role in determining the direction of BTC in the coming days.

Suppose BTC fails to maintain this support level. In that case, it may seek liquidity at lower levels, around $64,000, a significant price point coinciding with the 4-hour 200 moving average (MA) and the exponential moving average (EMA). This potential dip could trigger increased selling pressure as traders seek a trend reversal confirmation.

On the other hand, if Bitcoin can successfully hold above $66,000, it sets the stage for another attempt at the $69,000 resistance. Surpassing this level could pave the way for BTC to target the psychological milestone of $70,000.

The next few trading sessions are crucial for gauging market sentiment and investor behavior as traders weigh their options amid ongoing volatility. Ultimately, whether BTC can maintain its current support will significantly influence its price trajectory, making the $66,000 level a key area to watch closely in the days ahead.

Featured image from Dall-E, chart from TradingView