TL;DR

- Bitcoin reaches a new all-time high of $99.4k, but several risk indicators suggest potential demand exhaustion in the market.

- The concentration of supply between $87k and $98k indicates that a correction could face resistance due to the lack of available supply.

- The slowdown in realized profit volume and the stabilization of perpetual futures funding rates suggest a reduction in sell-side pressure.

Bitcoin has reached a new all-time high of $99.4k, a milestone in its bullish cycle. This increase has caused a massive redistribution of supply, as a large number of investors have reached high levels of unrealized profits. However, several risk indicators have shown warning signs, suggesting that the market may be approaching a period of exhaustion.

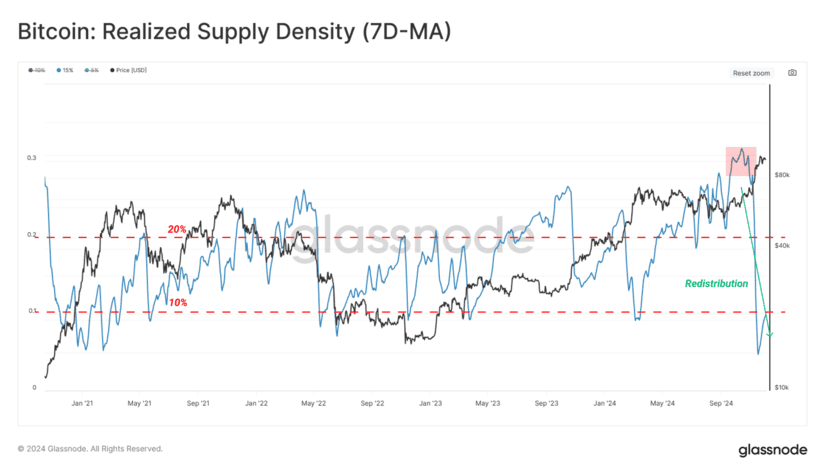

Over the past few months, Bitcoin had been trading within a price range of $54k to $74k, which allowed a large portion of the circulating supply to be redistributed at a higher price. Such market movements tend to generate a higher concentration of supply at certain price levels, increasing the possibility of volatility when corrections occur.

The Realized Supply Density analysis, which measures the concentration of supply around the current price, has shown a concentration between $87k and $98k. This indicates that if the price returns to these levels, the available supply could be insufficient to support a sharp decline.

The Crypto Market Situation

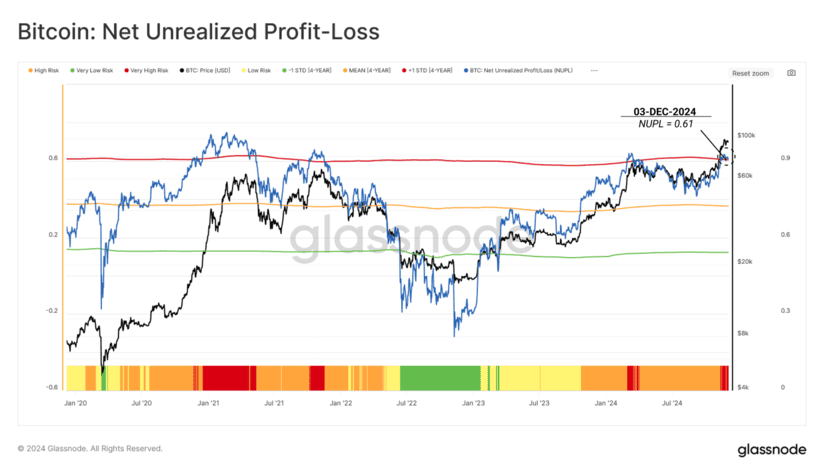

Additionally, the Percent of Supply in Profit (PSIP) has surpassed 90%, placing the market in what is called an “euphoria” phase. This historical indicator has been linked to periods of high vulnerability to downside corrections, as investors who have accumulated unrealized profits are more likely to sell to capitalize on those gains. The Net Unrealized Profit/Loss (NUPL) has also reached elevated levels, resulting from a market that maintains a high proportion of unrealized profits. This situation could generate increased sell-side pressure if prices start to pull back.

Despite the high-risk levels, some indicators show signs of a slowdown in sell-side pressure. Realized profit volume has dropped by 76% from its peak during the rally toward $100k, suggesting that the market may be experiencing a reduction in speculative activity. Perpetual futures funding rates have also started to stabilize, indicating that leveraged demand is beginning to cool off