Key Takeaways

- WisdomTree has filed for a spot XRP ETF with the SEC.

- The ETF would track XRP’s price, and Bank of New York Mellon is proposed as the trust administrator.

Share this article

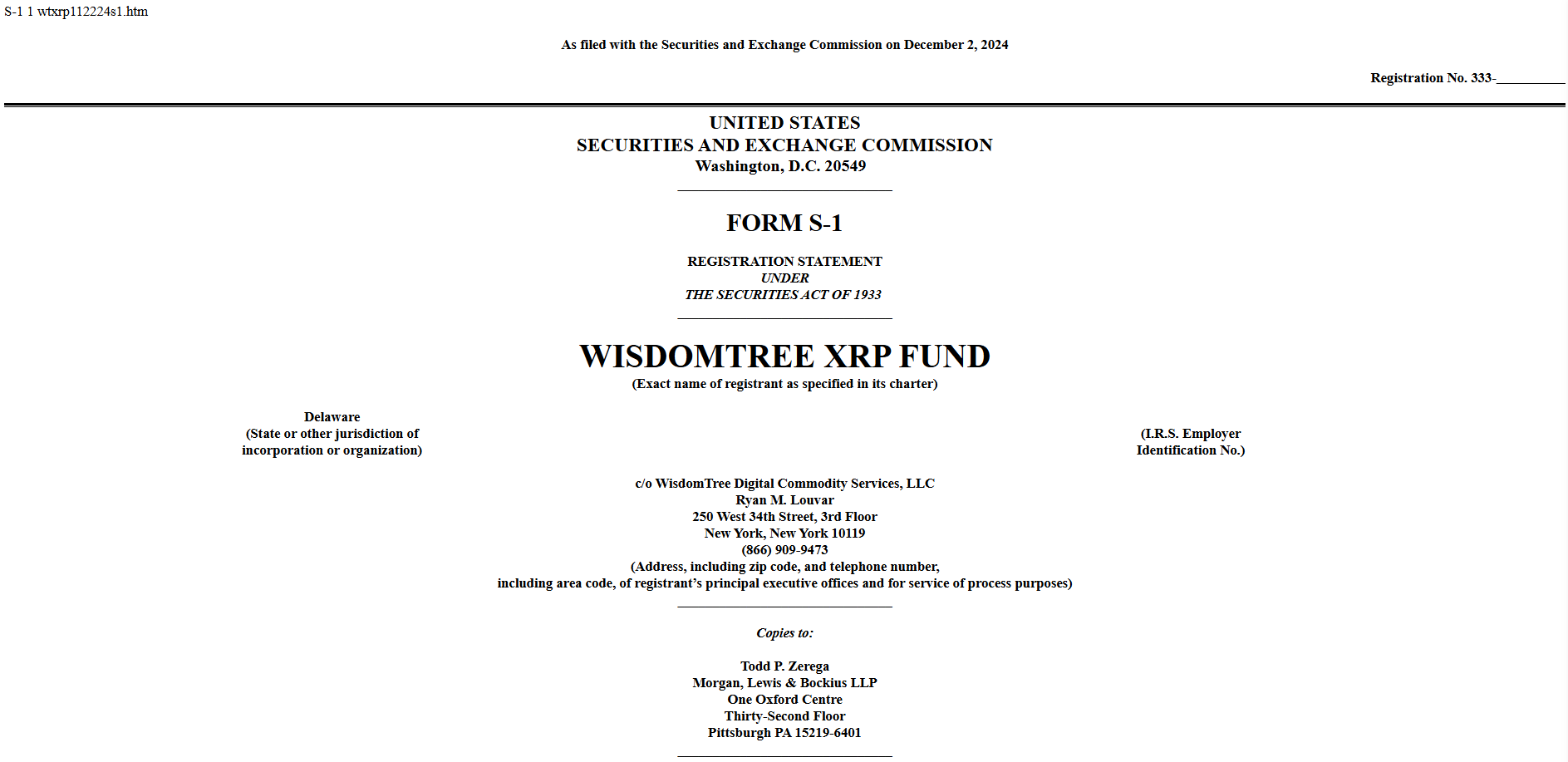

WisdomTree, managing a diverse portfolio of assets valued at $113 billion, has officially filed a Form S-1 registration statement with the SEC for its WisdomTree XRP Fund—a move that marks its entry into the growing field of asset managers seeking to launch XRP-based investment products.

According to a filing dated December 2, Bank of New York Mellon will serve as the administrator for the proposed trust. WisdomTree has not yet specified a ticker symbol for its proposed fund.

The ETF would track XRP’s price, which currently ranks as the third-largest crypto asset by market value. With the latest filing, WisdomTree joins a growing group of asset managers seeking to introduce XRP-based funds in the US, including Bitwise, 21Shares and Canary Capital, which filed for XRP ETFs earlier this year.

WisdomTree recently launched an XRP ETP, the WisdomTree Physical XRP (XRPW), in Europe. The product now trades on several European exchanges, including Deutsche Börse Xetra, Swiss Exchange, and Euronext.

Will leadership change at the SEC benefit XRP ETFs?

The ongoing legal battle between Ripple Labs and the SEC is likely to delay any initial attempts to launch an XRP ETF, as noted by Alex Thorn, Head of Research at Galaxy Digital, in his commentary on Bitwise’s proposed XRP ETF.

In October, the SEC decided to move forward with an appeal, challenging a court ruling that determined XRP sales on secondary markets to retail investors are not classified as securities transactions. Soon afterwards, Ripple Labs filed a cross-appeal in response to the SEC’s legal move.

Despite the SEC’s appeal, there is some optimism surrounding Gary Gensler’s upcoming resignation. Experts anticipate a shift in the SEC’s crypto regulatory approach under new leadership, potentially paving the way for XRP ETFs.

Share this article