Key Takeaways

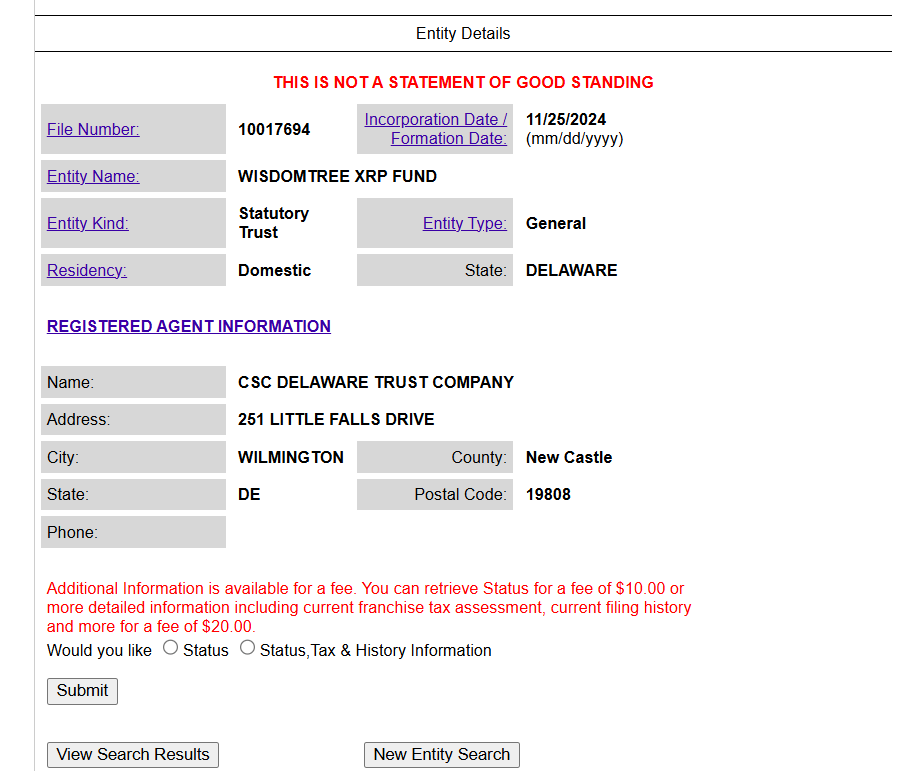

- WisdomTree filed to establish a Delaware trust for a proposed XRP ETF.

- This filing is part of increasing crypto ETF activity beyond Bitcoin and Ethereum.

Share this article

WisdomTree, managing approximately $113 billion in assets, has filed to establish a trust entity for a proposed XRP exchange-traded fund in Delaware. The trust filing represents a preliminary step in the ETF launch process, preceding a formal application to the SEC.

With this filing, WisdomTree is set to be part of a growing group of asset managers looking to launch an XRP ETF, following Bitwise’s lead from last month and Canary Capital’s subsequent filing.

The proposed XRP ETF would track the price of XRP, currently ranked as the sixth-largest crypto asset by market capitalization. The firm has not specified an exchange venue or ticker symbol for the proposed fund.

With SEC Chair Gary Gensler set to resign, speculation is mounting around the future of XRP ETFs, particularly given Ripple Labs’ long-standing legal battle with the regulator.

Experts believe that Gensler’s departure could lead to a reassessment of the SEC’s litigation approach, potentially easing the path for XRP ETFs under new leadership that may adopt a more favorable view of crypto assets.

Bitwise’s filing comes as asset managers increasingly explore crypto ETFs beyond Bitcoin and Ethereum, with applications for Solana, Litecoin, and HBAR now on the table.

Last week, Bitwise submitted an S-1 registration statement for its proposed Solana ETF, following in the footsteps of VanEck, 21Shares, and Canary Capital.

This is a developing story.

Share this article