Key Takeaways

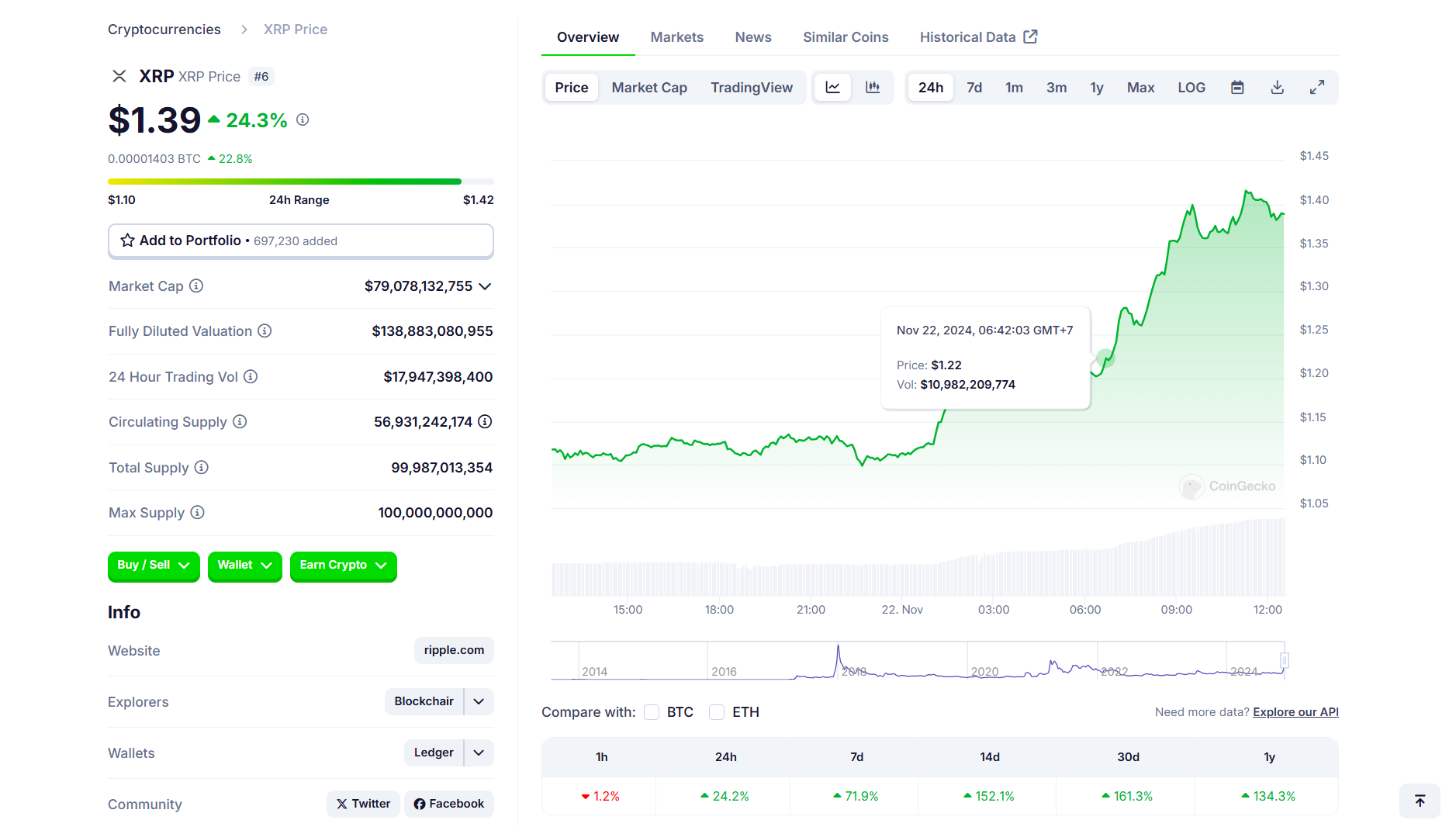

- XRP’s price surged 25% amid speculation of reduced SEC enforcement post-Gensler.

- Pantera anticipates fewer SEC lawsuits and possible dismissals after Gensler’s departure.

Share this article

Ripple’s XRP token rose by 25% on Friday to above $1.4, maintaining its upward trajectory after SEC Chair Gary Gensler announced his term will officially conclude on January 20. Gensler’s exit could prompt the agency to reassess its approach to current litigation, possibly leading to a decision against pursuing its appeal in the SEC vs. Ripple lawsuit.

Consensys CEO Joe Lubin expects a favorable legal environment for digital assets under Trump’s presidency. He suggests ongoing SEC cases against crypto companies may be “dismissed or settled.”

Pantera’s legal boss Katrina Paglia anticipates fewer actions and potential dismissals following the departure of Gensler. Many SEC lawsuits against crypto companies are expected to decrease or settle without major admissions of guilt post-Gensler.

New leadership may lead to the SEC coming to an agreement with Ripple rather than continuing its lengthy litigation process. Although financial penalties may be involved in a settlement, Ripple would be able to continue its operations without the burden of ongoing litigation.

XRP has skyrocketed 138% this year, dwarfing Ethereum’s performance and closing in on Bitcoin’s year-to-date gains, according to data from CoinGecko.

The sixth-largest cryptocurrency by market capitalization has experienced a period of stagnation since last year’s market recovery, with prices hovering between $0.5 and $0.6, while most of the crypto market is on the rise.

Just last week, XRP surpassed the $1 threshold, reaching its highest price in three years amid speculation about Gensler’s potential resignation and rumors of a meeting between Trump and Ripple’s CEO. The first has now been confirmed.

XRP now eyes the $2 level, according to crypto analyst Ali Martinez. He believes Gensler’s departure from the SEC is “the best thing that could happen to Ripple.”

‘@GaryGensler leaving the @SECGov is the best thing that could happen to @Ripple. Now, $XRP targets $2! https://t.co/YEDiZtrnB1 pic.twitter.com/LLE4n0MC8z

— Ali (@ali_charts) November 21, 2024

Prospective XRP ETFs

The potential approval of a spot XRP ETF in the US could act as a bullish driver for XRP’s price.

Bitwise and Canary Capital are seeking SEC approval for their respective spot XRP ETFs. These proposed ETFs are currently on hold due to ongoing legal disputes over XRP’s status as a security.

On Thursday, asset manager WisdomTree announced the launch of a physical XRP ETP in Europe.

The fund, also known as WisdomTree Physical XRP ETP (XRPW), aims to provide investors with exposure to the spot price of XRP.

WisdomTree claims that this product is the lowest-cost XRP ETP available in Europe and is fully backed by the underlying asset, securely stored in cold storage.

With this launch in Europe, many members of the crypto community are optimistic that similar XRP ETF products will soon debut in the U.S.

Share this article