TL;DR

- Tokenization is driving a revolution in the financial system, transforming traditional assets into more accessible, secure, and efficient digital representations.

- It offers greater financial inclusion, liquidity, and cost reduction by eliminating intermediaries in transactions.

- Its widespread adoption faces regulatory and technological challenges that must be overcome to maximize its positive impact.

Tokenization has emerged as one of the most disruptive innovations in the financial sector, with the potential to transform how we interact with assets and the economy at large.

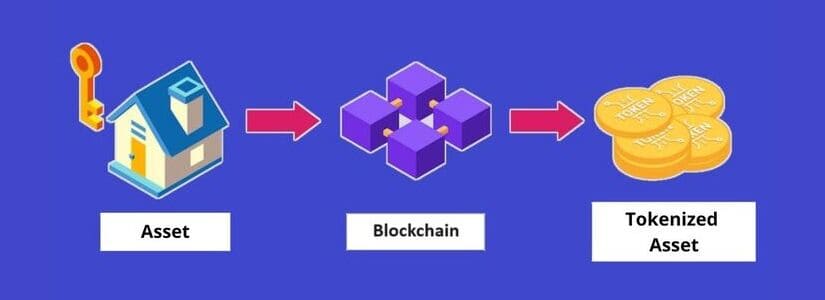

This process involves converting tangible and intangible assets into digital representations, known as tokens, which reside on a blockchain. While blockchain technology has primarily been popularized through cryptocurrencies like Bitcoin and Ethereum, tokenization expands the scope of possible applications. It provides a tool for traditional assets, such as real estate, stocks, bonds, and even artworks, to be digitized and fragmented into smaller units, making them accessible to a larger number of people.

Applications of Tokenization

One of the most significant changes tokenization could bring to the financial system is the reduction of intermediaries. Traditionally, financial transactions require the intervention of various entities, such as banks, custodians, and notaries, which increases costs and adds complexity to the process.

Democratizing the Economy

By digitizing and decentralizing these assets, the need for third-party involvement is eliminated, simplifying transactions and reducing fees. This not only enhances operational efficiency but also has the potential to democratize access to financial products that were previously reserved for large institutional investors.

Assets like real estate, corporate bonds, and company stocks can be fractionalized into tokens, allowing small investors to participate in markets that were previously inaccessible to them. This fosters financial inclusion, opening new investment opportunities to a broader range of people—a critical factor for developing economies.

More Liquidity and More Tools

Through tokenization, assets also gain liquidity. Often, certain assets like real estate or artworks are perceived as illiquid investments due to their high value concentration and the lack of straightforward mechanisms for buying and selling. However, by tokenizing them, these assets can be divided into smaller fractions that are easy to transfer, sell, and trade. This increases liquidity, benefiting both investors and companies seeking more efficient financing options.

Additionally, tokenization improves security. Thanks to blockchain technology, assets benefit from immutable traceability, making them difficult to alter or counterfeit. This boosts trust and safeguards both personal data and asset ownership. Moreover, the ability to verify authenticity facilitates regulatory compliance and audits, reducing the risk of fraud.

Challenges to Overcome

However, despite its enormous potential, the adoption of tokenization still has a long way to go. One of the main obstacles is the lack of clear and standardized regulation to enable the orderly development of this market. While some countries have already implemented pilot projects, most jurisdictions have yet to define regulatory frameworks that ensure investor protection and financial system stability. Regulators must carefully address these issues to mitigate risks related to volatility or misuse.

Another challenge is technological infrastructure. While blockchain technology has proven to be robust and secure, its widespread implementation in financial systems requires modernizing the current technological infrastructure. Banks and other financial institutions will need to make significant investments to enhance their technological capabilities and integrate tokenization into their daily operations. This will involve adapting their systems and training personnel in using new tools, which could be costly and complex.

Tokenization is far more than a revolutionary tool—it is laying the foundation for a new global economy. Its ability to improve transaction efficiency, reduce costs, and democratize access to assets has already begun reshaping the traditional financial system. However, for this transformation to succeed, regulatory and technological challenges must be resolved