TL;DR

- Solana has recorded growth of over 2,100% in the past two years, establishing itself as one of the most prominent cryptocurrencies in the market.

- Since 2022, SOL has outperformed Bitcoin and Ethereum in terms of capital inflows, accumulating more than $55 billion in net liquidity.

- Although it faces potential overheating points, indicators suggest that SOL still has room for growth in this cycle.

Over the past two years, Solana has been one of the strongest cryptocurrencies in the market, with exceptional growth exceeding 2,100%.

Since the all-time low reached in November 2022, Solana has outperformed Bitcoin and Ethereum in terms of price appreciation and has attracted a considerable amount of capital, with a net liquidity increase of over $55 billion. This steady flow of investments has been key to its recovery, solidifying SOL as one of the top choices for investors in the crypto market.

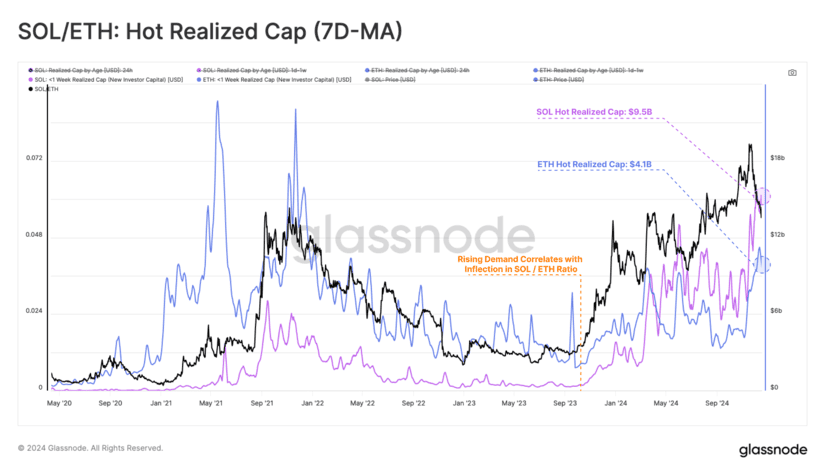

The analysis of new indicators in these capital flows provides better insights into investor behavior. Among these are “realized” capital flows, which measure daily changes in liquidity within the network. Since September 2023, Solana has experienced positive capital inflows, reaching a record of $776 million per day. This pattern has been fundamental to its growth, demonstrating sustained demand from new investors.

Solana Has Not Reached Peak Profitability Levels

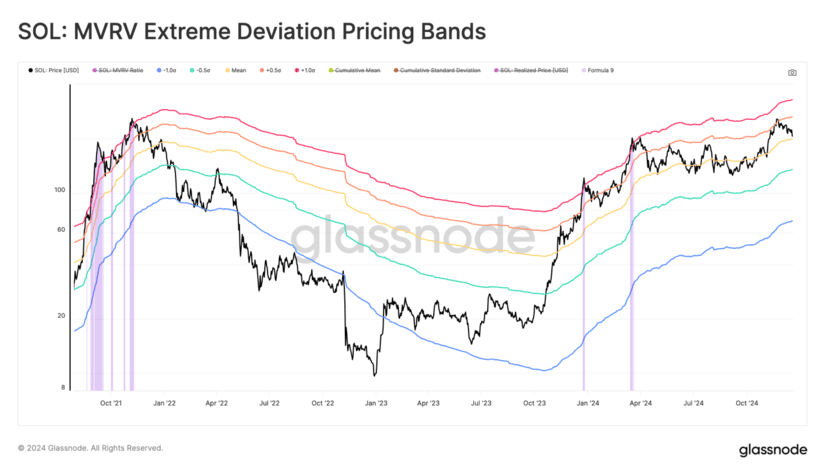

Moreover, a more detailed analysis of investor profitability shows that, although there has been significant profit-taking distribution, Solana has not yet reached the historical levels of unrealized profitability that typically mark the end of bullish cycles. This behavior suggests that SOL still has potential for further growth throughout its cycle.

The market has responded favorably, and Solana’s market capitalization has increased significantly, rising from $22 billion to $91 billion. This marks a substantial recovery following the crisis caused by the collapse of FTX. As of the time of writing, SOL is trading at approximately $190 per unit, showing a slight 1% decline due to market volatility.

However, despite the optimism, some analysts warn of the possibility that the market is approaching an overheating point. Currently, SOL’s price is in a relatively high range, which could create short-term profit-taking pressure. Nonetheless, indicators also suggest there may still be room for further growth before the market faces a correction