TL;DR

- MARA Holdings has acquired 15,574 BTC for $1.53 billion, raising its total holdings to 44,394 BTC, valued at $4.45 billion.

- The company follows a “HODL” strategy, holding all its acquired Bitcoin and betting on its growing importance in its business model.

- With a return of 60.9%, MARA is positioned as the second public company with the largest Bitcoin reserves, just behind MicroStrategy.

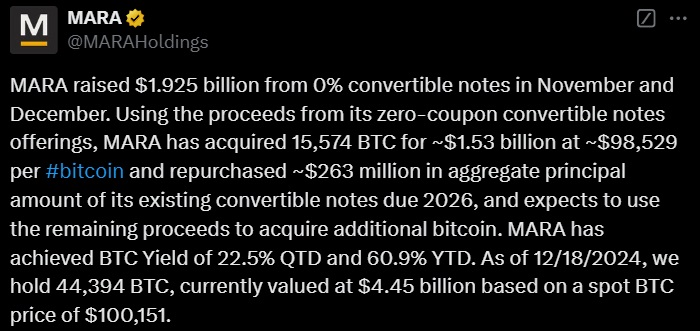

MARA Holdings continues to advance in its Bitcoin investment strategy, as the firm has just acquired 15,574 BTC for a total of $1.53 billion. The purchase was made at an average price of $98,529 per unit and is part of the $1.925 billion raised through the issuance of 0% convertible senior notes. These issuances took place in late November and early December.

With this investment, MARA has increased its total accumulated Bitcoin to 44,394 BTC, currently valued at $4.45 billion. The company follows a strategy similar to other large entities, such as MicroStrategy, adopting a “HODL” plan, meaning it does not sell the acquired Bitcoin but rather keeps it in its treasury for the long term. The company has confirmed it will continue its periodic Bitcoin purchasing policy, betting on its growing importance in its business model.

The investment has performed excellently, reaching a return of 60.9% as measured by “BTC Yield,” an indicator that shows the effectiveness of Bitcoin accumulation strategies. This return is calculated from the beginning of the year to December 19, 2024, demonstrating the great success of the company’s strategy based on cryptocurrency adoption.

MARA Grows, But Still Far Behind MicroStrategy

Thanks to this new acquisition, MARA positions itself as the second public company with the largest Bitcoin reserves in the world, just behind MicroStrategy, which still leads the list with 439,000 BTC. Saylor’s firm has increased its reserves in recent weeks, resulting in an unrealized gain of over $18 billion.

Large corporations continue to accumulate Bitcoin and make it part of their financial strategy. The role of the cryptocurrency as a reserve asset and its potential as a long-term investment vehicle have been clearly demonstrated. This trend is likely to continue as BTC is increasingly adopted by various markets