- Timing is crucial during the Bitcoin cycle peak, as the profit window lasts only around 26 days per cycle.

- Altcoins typically peak two weeks after Bitcoin’s top, making strategic planning essential for investors.

In his recent video, crypto influencer Lark Davis delves into the vital topic of the Bitcoin cycle peak price, offering valuable information for investors seeking to make informed decisions.

Davis underlines that the cycle peak comes quickly and randomly, thereby giving little opportunity for profit-taking. Blinded by hope, many traders miss this fleeting chance and discover themselves with assets through the next market slump.

The Critical Role of Timing in Bitcoin and Altcoin Cycles

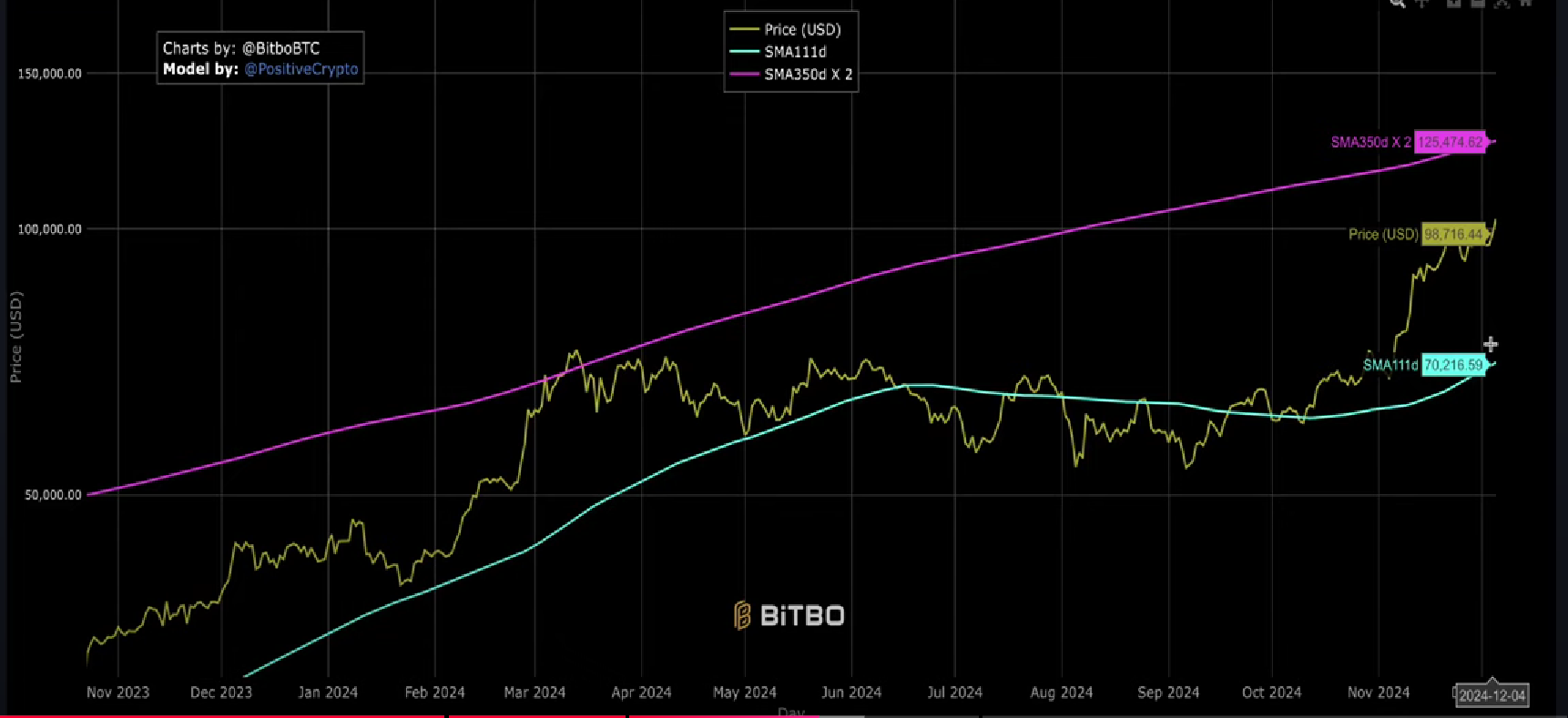

Davis emphasizes the importance of understanding the historical price trends of Bitcoin. Data shown in the video indicates that Bitcoin usually stays in the high-profit “red zone” for just 26 days per cycle and spends less than 2% of its time over the important “orange line.”

This limited window emphasizes the significance of exact timing for maximizing the benefits from market highs. As Davis says, “You won’t perfectly sell the price top, but selling close enough matters.”

Emphasizing Bitcoin’s position as the “north star” for the market, Davis shows how altcoins follow its lead through market cycles. Davis compares this phenomenon to a Tom Hanks meme, where Bitcoin leads and altcoins follow. When one considers altcoin market behavior, which usually peaks two weeks following Bitcoin’s peak, this link becomes quite important.

Understanding BTC Peaks and the Pi Cycle Top Indicator

Based on his theory of a March–April peak for Bitcoin, Davis projects a market top in mid-2025. He uses the Pi Cycle Top Indicator as a consistent instrument for spotting these pivotal occasions. This indicator has historically faithfully indicated market tops, giving traders useful information.

For example, traders might guarantee almost maximum returns by selling within days of the Pi Cycle Top Indicator flashing in 2021.

Drawing on prior cycles, Davis shows how ephemeral peak prices are. While the larger sell window in 2017 ran four to six weeks, Bitcoin’s $20,000 peak lasted only a few hours.

Likewise, the 2021 cycle had two different chances to sell above $60,000; many traders missed these chances by keeping their assets in the bear market and lost large value.

Projected Bitcoin Peaks and Strategic Profit Opportunities

Davis projects for this cycle a possible Bitcoin peak between $150,000 and $200,000 by March or April 2025. With a projected three-to-six-week window for selling at reasonable prices, he says this time will offer a perfect chance for profit-taking.

He also emphasizes that altcoins necessitate a more tactical approach because of their shorter profit windows, even while some traders might want to keep Bitcoin long-term.

Davis emphasizes for viewers the need for aggressive profit-taking. The rapid rise and fall of market cycles offer little room for doubt, and neglecting to act during the distribution period can result in lost possibilities. “Enjoy the bull market,” he advises, then “remember—it’s just a bull market.”

On the other hand, CNF previously highlighted a Standard Chartered Bank executive predicting a new ATH for BTC at $125K before 2024 ends.

Meanwhile, at the time of writing, BTC is swapped hands at about $99,631.05, up 30.18% over the last 30 days and still dancing below its psychological level, $100k.