TL;DR

- HYPE has risen by over 273% since its launch, reaching a price of $12.03 and a fully diluted valuation exceeding $12 billion.

- Its success reinforces the shift toward decentralized platforms (DEXs), standing out for its high trading volume and total value locked.

- The token secures the network through staking and serves as a gas token, enhancing its utility within the ecosystem.

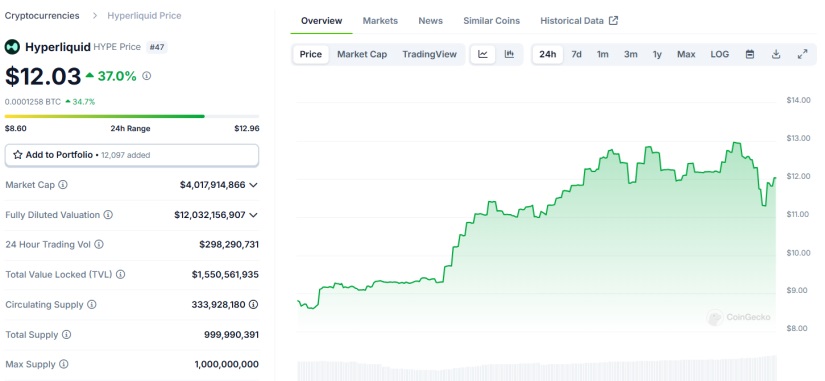

The HYPE token, developed by Hyperliquid, has experienced a surge of over 273% in value since its launch on November 29. Currently, the token is priced at $12.03 after a 37% increase during the last 24 hours. This growth has driven its fully diluted valuation to over $12 billion. With 333 million tokens in circulation out of a total supply of 1 billion, its market capitalization stands at approximately $4 billion.

The token’s excellent performance reflects both strong investor interest and a broader market shift toward decentralized platforms. Over the past 24 hours, the token’s trading volume exceeded $298 million, underscoring its high liquidity and demand.

Thanks to this momentum, Hyperliquid has risen to lead the market in terms of trading volume and total value locked (TVL), positioning itself as a key platform within the ecosystem of decentralized perpetual exchanges, according to DeFiLlama data.

The success of its launch demonstrates the clear and growing preference of developers to hold token generation events on decentralized exchanges (DEXs) rather than centralized platforms (CEXs). Anmol Singh, co-founder of Zeta Markets, remarked that this shift reflects a need for greater transparency and alignment with users, traits inherent to DEXs. Singh predicts that by 2025, most token launches will take place on these platforms.

HYPE Token Functions

HYPE plays a central role within the ecosystem. The token can be used for staking in the HyperBFT consensus mechanism, an optimized proof-of-stake (PoS) system that ensures network security and promotes decentralization. Additionally, it serves as the native gas token in the execution environment, facilitating transaction fee payments within the ecosystem