TL;DR

- Digital asset investment products saw inflows of $270 million last week, reaching an annual record of $37.3 billion.

- Bitcoin experienced outflows of $457 million due to profit-taking after touching $100,000, while Ethereum saw inflows of $634 million.

- XRP received inflows of $95 million due to growing interest in its potential inclusion in a U.S. exchange-traded fund (ETF).

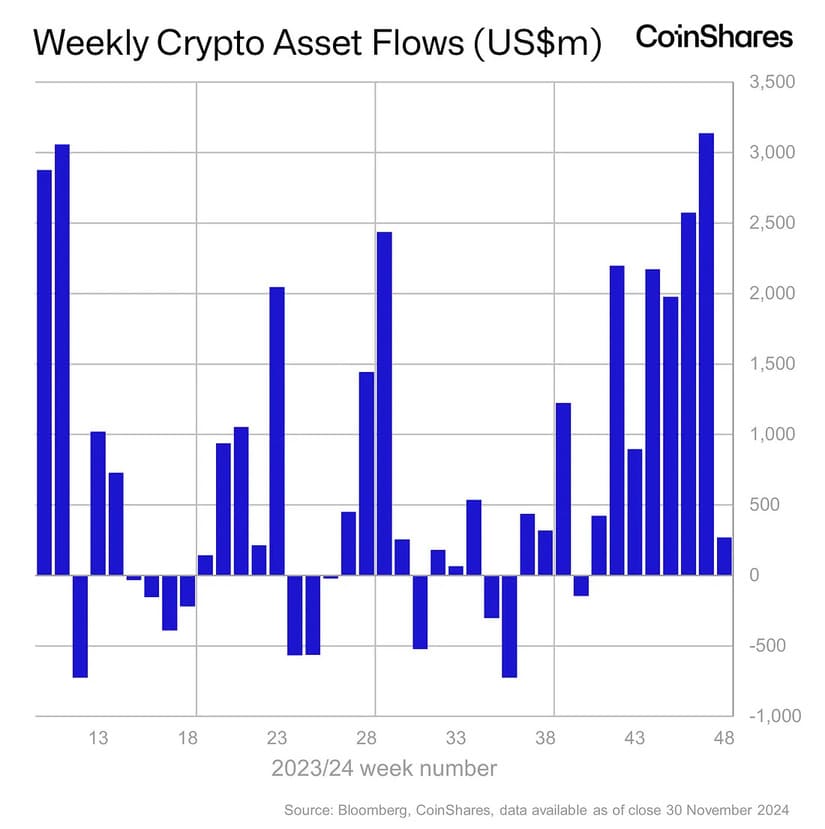

The digital asset market continues to show exponential growth, although with some fluctuations in investment flows during the last week. In total, these assets saw inflows of $270 million, bringing the total inflows to a historic record of $37.3 billion for the current year.

How Did Digital Assets Perform This Week?

Market behavior was diverse, with clear differences among the most important cryptocurrencies. Bitcoin, for example, recorded outflows of $457 million, marking the first significant outflow of this kind since early September. Analysts attribute this change to profit-taking by investors, especially after BTC touched the psychological level of $100,000, causing a price correction.

On the other hand, Ethereum saw a notable reversal in market sentiment. The cryptocurrency received inflows of $634 million, pushing its annual flows to a total of $2.2 billion, surpassing its 2021 inflow record of $2 billion. The renewed interest in Ethereum shows a positive shift in market perception, backed by strong demand for related investment products.

Ethereum Revives and XRP Continues to Attract Investors

XRP also saw positive inflows, reaching $95 million, driven by growing interest around the possibility of the cryptocurrency being included in a U.S. exchange-traded fund (ETF). This factor has been key in attracting more investors to the XRP network.

Regarding the geographical distribution of flows, the U.S. led the way with $266 million in inflows, followed closely by Hong Kong and Germany, with $39 million and $12.3 million, respectively.

In contrast, Switzerland and Canada recorded smaller outflows of $26 million and $10 million, respectively. Although flows have mostly been positive, the market continues to show mixed signals, particularly in relation to exchange-traded funds, where the volume experienced a slight decline during the last week