TL;DR

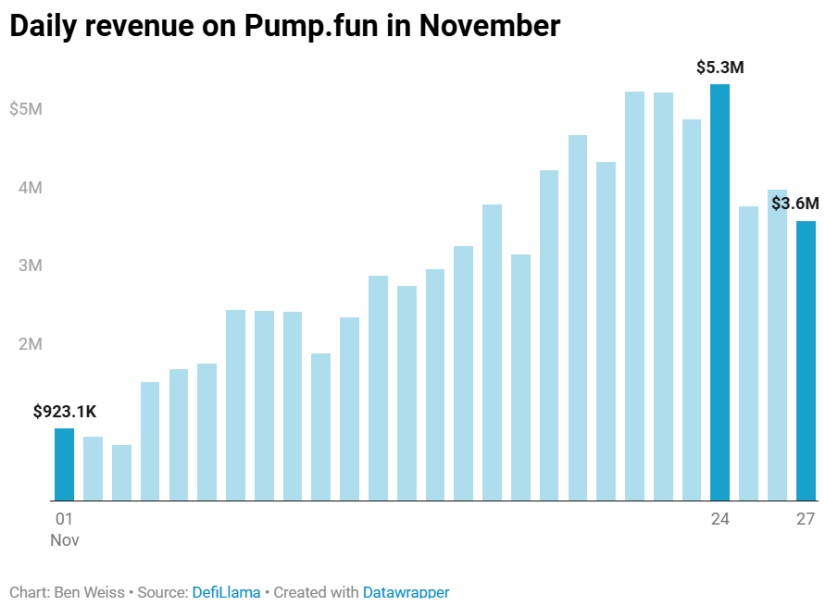

- Pump.fun experienced a 33% drop in revenue, the largest since March, falling from $5 million to $3.6 million in just one day.

- A user faked his suicide to promote their cryptocurrency, causing outrage and leading Pump.fun to disable the livestreaming feature.

- Disinterest in memecoins and the rise of negative sentiment have led traders to shift to other platforms, such as Base.

Pump.fun, the platform that allows users to create and launch their own memecoins, has experienced a 33% drop in revenue, a sharp decline that represents its largest fluctuation since March.

According to data from DefiLlama, the platform’s daily revenue dropped from $5 million to $3.6 million in just one day. This change has been attributed to a series of controversial events that took place in mid-November.

What Happened with Pump.fun?

The situation was triggered by an incident in which a user faked his suicide as part of a strategy to promote their own cryptocurrency. The event caused great outrage within the community, and after the controversy, Pump.fun decided to disable the livestreaming feature on the platform. This type of extreme content had been a frequent feature in streams, which seemingly contributed to the unrest among users.

Repercussions and Market Sentiment

At the same time, disinterest in memecoins within Pump.fun has grown, generating an increase in negative sentiment towards the platform. According to Min Jung, an analyst at Presto Labs, many users have expressed their fatigue with these assets, which has affected activity on the platform. Additionally, traders are starting to migrate to other ecosystems, such as Base, a Layer-2 blockchain developed by Coinbase.

Despite the revenue drop, Pump.fun remains a highly relevant platform in the market, having generated nearly $230 million in total revenue since its launch in January. However, recent changes on the platform reflect an evolution in user dynamics and the memecoin market.

Other projects, such as Virtuals, a protocol for buying and selling stakes in AI characters, and Clanker, an AI tool for launching memecoins, are experiencing significant increases in trading volume, indicating a potential shift in interest toward new projects