TL;DR

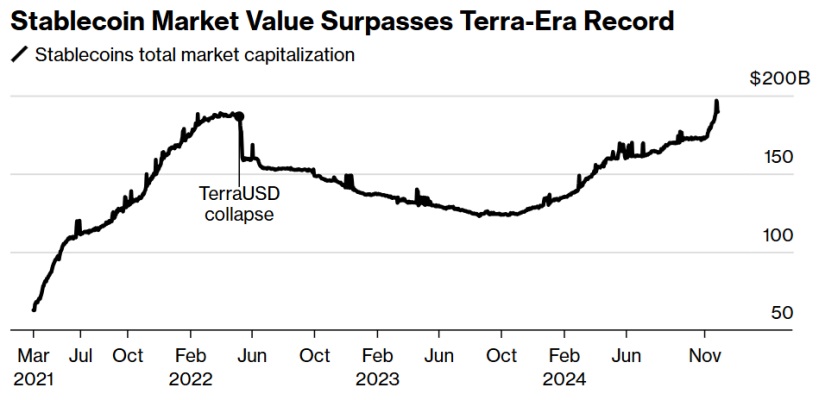

- The stablecoin market capitalization reached $190 billion in 2024, growing 46% and surpassing pre-TerraUSD collapse levels.

- Tether leads the market with $133 billion in circulation, while expanding USDT usage in traditional sectors like commodities.

- Moves such as Stripe’s acquisition of Bridge and PayPal’s entry into the market highlight the growing acceptance of stablecoins in traditional finance.

The stablecoin market has reached a new all-time high this year, with a total capitalization nearing $190 billion, achieving a 46% growth compared to the previous year.

This increase, which surpasses the levels seen before TerraUSD’s collapse in 2022, reflects strong renewed confidence in these digital assets. Stablecoins now seem to be solidifying their role not only as tools to facilitate transactions within the crypto market but also as key instruments for global trade and cross-border payments.

Tether Dominates the Stablecoin Market

Tether, the issuer of USDT and the undisputed market leader, has expanded its stablecoin circulation to $133 billion, accounting for 70% of the total market. The company has diversified its operations, recently funding its first crude oil transaction in the Middle East—a strategic move to integrate USDT into traditional sectors like commodities. These initiatives are crucial for USDT to transition from being solely a crypto product to occupying a broader role in the global economy.

The growing interest in stablecoins is also evident in corporate actions. Stripe, one of the world’s most valuable fintech companies, announced its acquisition of the stablecoin startup Bridge for $1.1 billion, marking one of the largest deals in the sector. Companies like PayPal are also entering the market.

Greater Acceptance and an Optimistic Future for the Sector

There is increasing acceptance of stablecoins in traditional finance. According to analysts, these developments could help mitigate systemic risks, avoiding abrupt market crashes like the one triggered by TerraUSD’s collapse, which left a $19 billion gap in the market.

On another note, the resurgence of interest in cryptocurrencies has coincided with a shift in the political landscape. Donald Trump’s victory in the U.S. presidential elections spurred a rally in the crypto market, driven by his promises to implement more favorable policies for the sector. Since then, the digital assets market has gained nearly $1 trillion in value.