Key Takeaways

- US Bitcoin ETFs saw massive outflows of $435 million as Bitcoin’s price fell below $93,000.

- MicroStrategy made its largest Bitcoin purchase ever, acquiring 55,500 BTC worth $5.4 billion.

Share this article

US Bitcoin ETFs faced massive outflows on Monday amid Bitcoin’s retreat below $93,000.

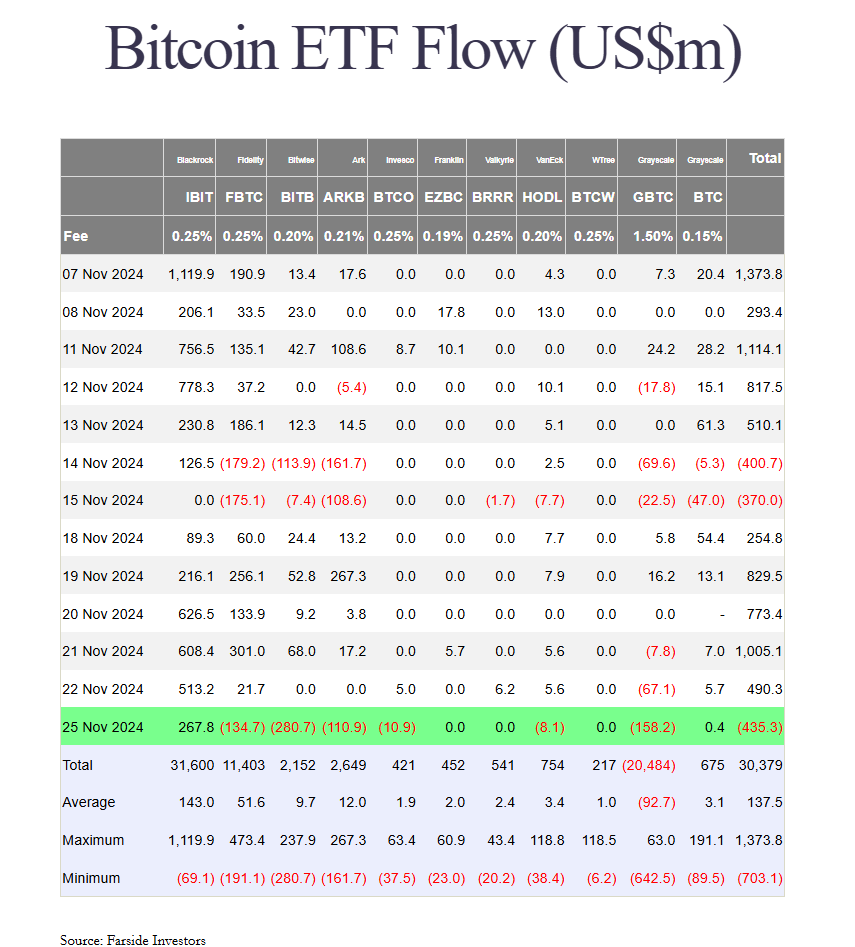

The eleven spot Bitcoin ETFs collectively saw net outflows totaling $435 million, with only BlackRock’s iShares Bitcoin Trust (IBIT) and Grayscale’s Bitcoin Mini Trust (BTC) attracting inflows.

According to data from Farside Investors, IBIT captured approximately $268 million in net inflows, while BTC took in $400,000.

Bitwise’s Bitcoin ETF (BITB) and Grayscale’s Bitcoin Trust (GBTC) faced substantial investor withdrawals. BITB recorded its largest-ever outflow of $280 million, while GBTC saw its most significant daily redemption in three months, amounting to $158 million.

Fidelity’s Wise Origin Bitcoin Fund (FBTC) and ARK Invest’s Bitcoin ETF (ARKB) saw outflows of $135 million and $111 million, respectively. Invesco and Valkyrie’s funds collectively lost $19 million.

The intense outflows marked a sharp reversal from last week’s performance when US Bitcoin ETFs attracted $3.3 billion, with BlackRock’s iShares Bitcoin Trust (IBIT) securing over 60% of total inflows.

The setback came as the broader crypto market turned bearish.

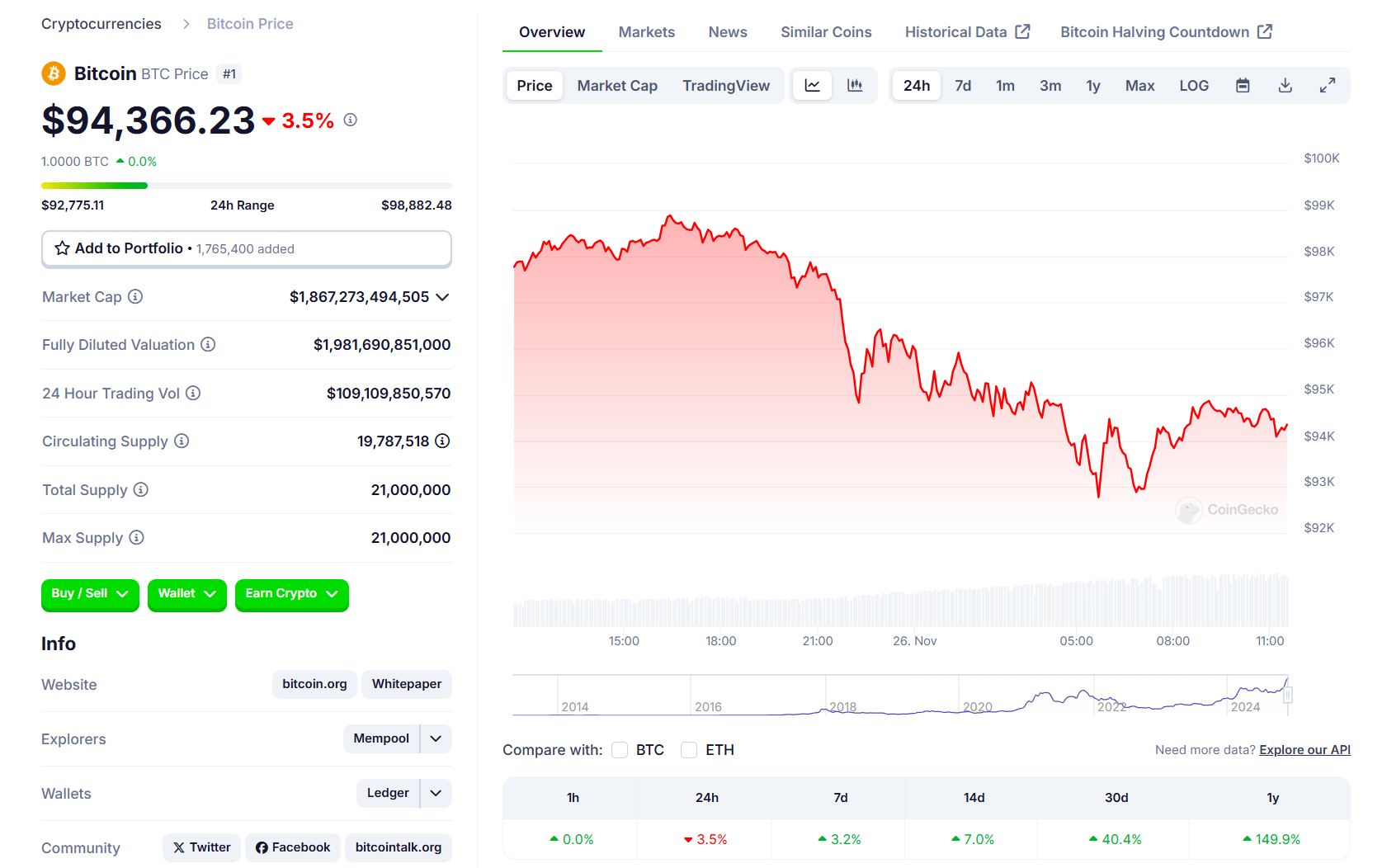

Bitcoin’s recent push for $100,000 was thwarted as it fell under $93,000, according to data from CoinGecko. The flagship crypto is now trading at around $94,300, down 3.5% in the last 24 hours.

The decline came amid increased selling pressure from long-term holders, who have sold over 461,000 BTC since the asset’s recent peak above $99,000, Crypto Briefing reported.

Despite the bearish trend, there’s speculation about a potential rebound if the price stabilizes and reaccelerating investor demand. On Monday, MicroStrategy announced it had acquired another 55,500 BTC worth $5.4 billion. It’s the company’s largest Bitcoin acquisition to date.

Market participants are monitoring macroeconomic factors, including inflation data and Federal Reserve statements, which could influence near-term price action.

Share this article