TL;DR

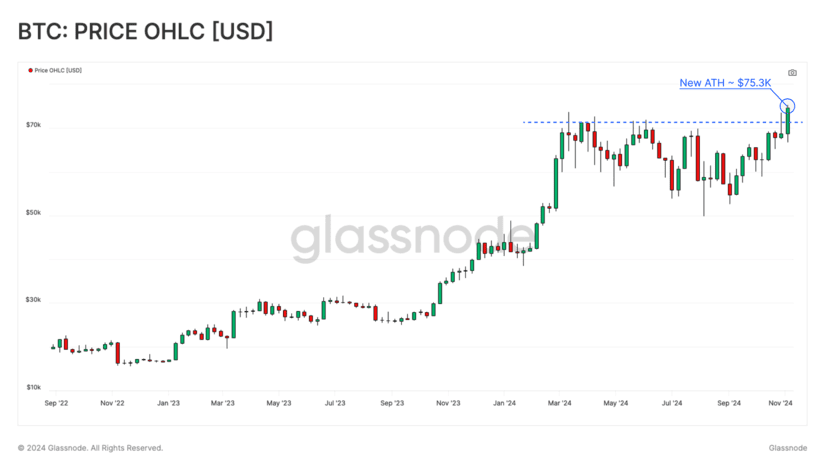

- Revolution in the crypto market: Bitcoin has reached a new all-time high of over $75,000, driven by Donald Trump’s victory as a key factor.

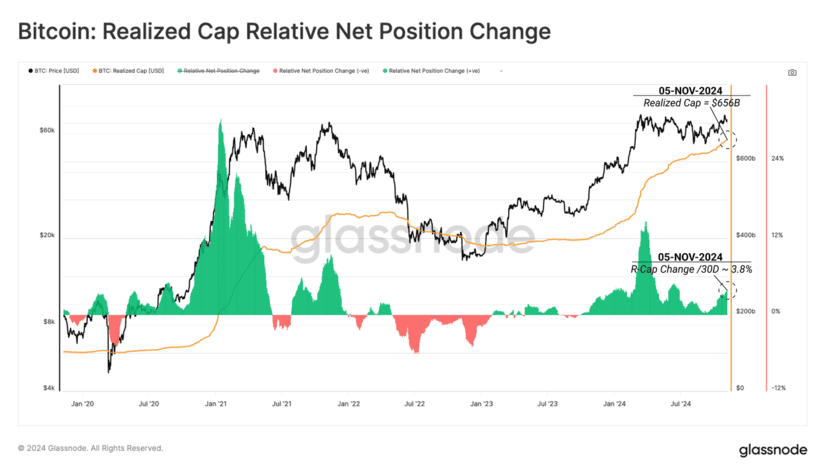

- Capital flows into BTC have increased significantly since September, reaching a record level of $656 billion in “Realized Cap.”

- Options markets reflect expectations of high volatility due to political and economic uncertainty.

Bitcoin has reached a new all-time high, surpassing $75,000 for the first time in its history, driven by a variety of factors.

This significant surge occurred amid speculation about the results of the U.S. presidential election. As the first results began to come in, a nearly irreversible trend started to form, indicating Donald Trump’s victory. This generated a climate of uncertainty, while simultaneously attracting strong interest in assets like Bitcoin, leading to a breakout in its price to new levels.

Huge Capital Flow into Bitcoin

Since the beginning of September, capital flows into Bitcoin have been steadily growing. The capital invested in the cryptocurrency has reached record figures, with an increase in the “Realized Cap,” now at a historic level of $656 billion.

This reflects strong demand from investors looking to capitalize on the market’s strength, while traders are taking profits during the price increases. Despite the profit-taking, realized losses remain minimal.

The Market Expects High Short-Term Volatility

On the other hand, volatility has once again become a dominant theme. Options markets show high expectations of sharp price movements. Options contracts have reached an open interest volume of $25.2 billion, reflecting the strong interest from institutional investors betting on increased volatility in the near future. This is also evident in the rise of implied volatility, especially in short-term contracts, pointing to an environment of uncertainty with the upcoming election results.

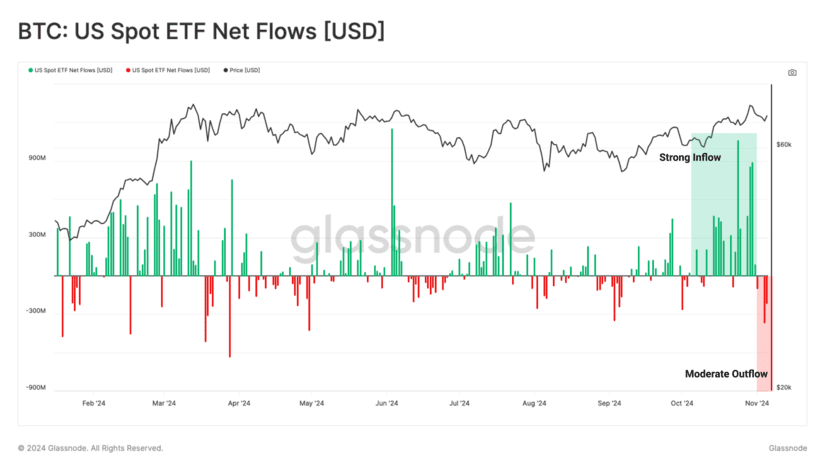

ETFs Lose Traction

Although Bitcoin ETFs have shown significant demand throughout the month, a slight slowdown in inflows has been observed in recent days due to the volatility associated with the election. However, the formation of this new all-time high could attract even more capital in the coming days, especially from investors looking to capitalize on the bullish trend.

Bitcoin has surpassed its previous highs due to the U.S. political context. Volatility remains a key factor in the current dynamics, suggesting that the cryptocurrency’s price will continue to fluctuate in response to political and economic events.