TL;DR

- Despite an increase in revenue in the third quarter, Coinbase faces a challenging market and has lost the confidence of retail investors.

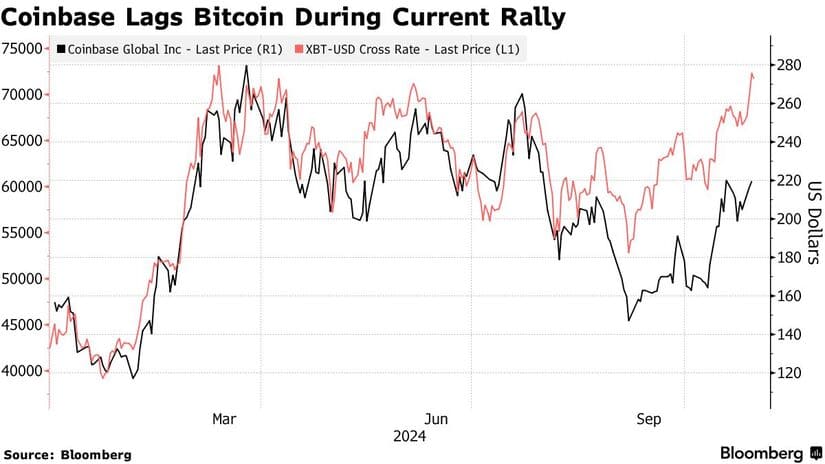

- The exchange’s shares have grown 27% this year. However, they are 40% below their all-time high.

- Coinbase is diversifying its revenue sources. Approximately half comes from institutional trading and non-trading services.

Despite the notable rebound in its revenue during the third quarter, Coinbase Global Inc. is facing a challenging crypto market.

Analysts anticipate that the company will double its revenue for the second consecutive quarter and predict a return to profitability with the publication of its financial results. However, the growing reluctance of retail investors has raised concerns in the market and within the company, as they believe they have not yet regained the trust of this group of clients.

Throughout the year, Coinbase’s shares have experienced nearly a 27% increase, although this growth falls short compared to the 70% rise registered by Bitcoin during the same period. Additionally, the stock price remains around 40% below the all-time high it reached during the industry’s boom at the end of 2021.

Has Interest in Bitcoin Decreased?

The disinterest of individual investors in trading digital assets has been a determining factor in the lack of enthusiasm. After a brief return to the market at the beginning of the year, many investors have chosen to stay on the sidelines, as evidenced by the decrease in searches related to Bitcoin, which have fallen to levels not seen in at least a year. This situation has led some analysts to question whether the fourth quarter will be equally successful.

Despite the decline in trading volumes, some indicators have shown signs of improvement. In October, volumes began to increase again, driven by a new attempt by Bitcoin to reach an all-time high. However, Coinbase’s engagement metrics remain a cause for concern, as its market share in the spot market fell to 4.18% in the third quarter. Competitors like Crypto.com and Bybit have gained ground, especially due to the wider variety of tokens they offer.

Coinbase Turns to Diversification to Increase Its Revenue

Beyond the adversities, Coinbase is diversifying its revenue sources. A significant portion is coming from institutional trading and non-trading services. Approximately half of its revenue in the second quarter came from these areas, which could help the company stay afloat amid uncertainty.

Awaiting Greater Regulatory Clarity

The political context is also a factor to consider, as the U.S. presidential elections could influence Coinbase’s future. The company is involved in litigation with the Securities and Exchange Commission, seeking a regulatory framework more favorable to cryptocurrencies. The expectation is that, once the elections are over, there will be greater clarity about the economy and the market, which could lead to an increase in trading volumes and benefit the exchange in the long term