TL;DR

- 10x Research estimates that Bitcoin could reach $100,000 by January 2025, driven by its prediction model and recent buy signals.

- The “Bitcoin black hole effect” highlights BTC’s dominance in absorbing value from altcoins, reflecting growing interest among institutional investors.

- Ethereum could benefit from new regulatory changes, although the firm remains cautious about its long-term growth.

Crypto research firm 10x Research has published an optimistic projection for Bitcoin (BTC), estimating that its price could reach $100,000 by January 2025.

The forecast is based on recent buy signals and what the firm calls the “Bitcoin black hole effect,” referring to BTC’s increasing dominance as it absorbs value from altcoins and other alternative assets.

According to 10x Research, its prediction model—which has shown 86.7% accuracy across the last 15 signals—triggered its latest buy signal on October 14, historically indicating a potential 40% price increase for Bitcoin over the following three months. With the current price around $72,300, a 40% rise would push BTC past $100,000 by January of next year.

Bitcoin: Digital Gold

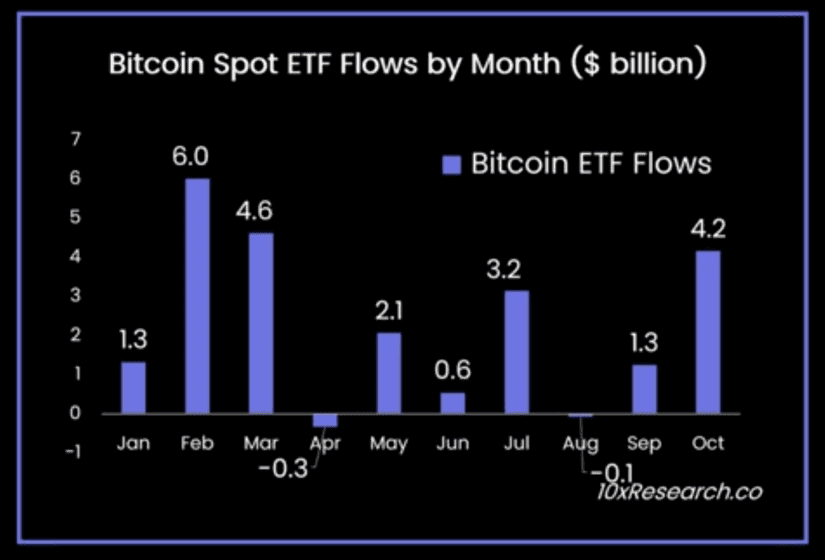

The analysis highlights the role of institutional investors, who have started to view BTC as a secure asset akin to “digital gold.” Bitcoin ETFs have gained substantial traction. In October alone, these products raised around $4.1 billion, and financial groups like BlackRock see BTC as a long-term investment. According to 10x Research, institutional attraction to the cryptocurrency reflects a perception of stability that Bitcoin is beginning to establish among institutional investors.

An indirect effect of BTC’s price rise has been an increase in the value of Bitcoin mining company stocks, a trend that 10x Research had previously anticipated. Growing institutional demand and BTC’s appreciation have strengthened the mining market, reinforcing its ecosystem.

Low Expectations for Ethereum

The firm also commented on Ethereum (ETH) and its future in the market. While they expect short-term growth potential, they remain more skeptical about ETH’s long-term performance due to low returns over the past two years and what they see as a stagnation in its development compared to BTC.

Donald Trump’s Victory

Even so, regulatory changes could benefit Ethereum and other cryptocurrencies, as new regulations will allow companies to report their crypto assets at market price, potentially facilitating institutional adoption of BTC and possibly ETH.

Finally, the report suggests that Donald Trump’s victory in the 2024 U.S. presidential election could positively impact the crypto market, aligning with the idea that economic uncertainty encourages the search for alternative assets like BTC