TL;DR

- Worldcoin (WLD) faces strong selling pressure due to massive liquidations by Alameda Research, which has sold 143,770 tokens weekly on Binance.

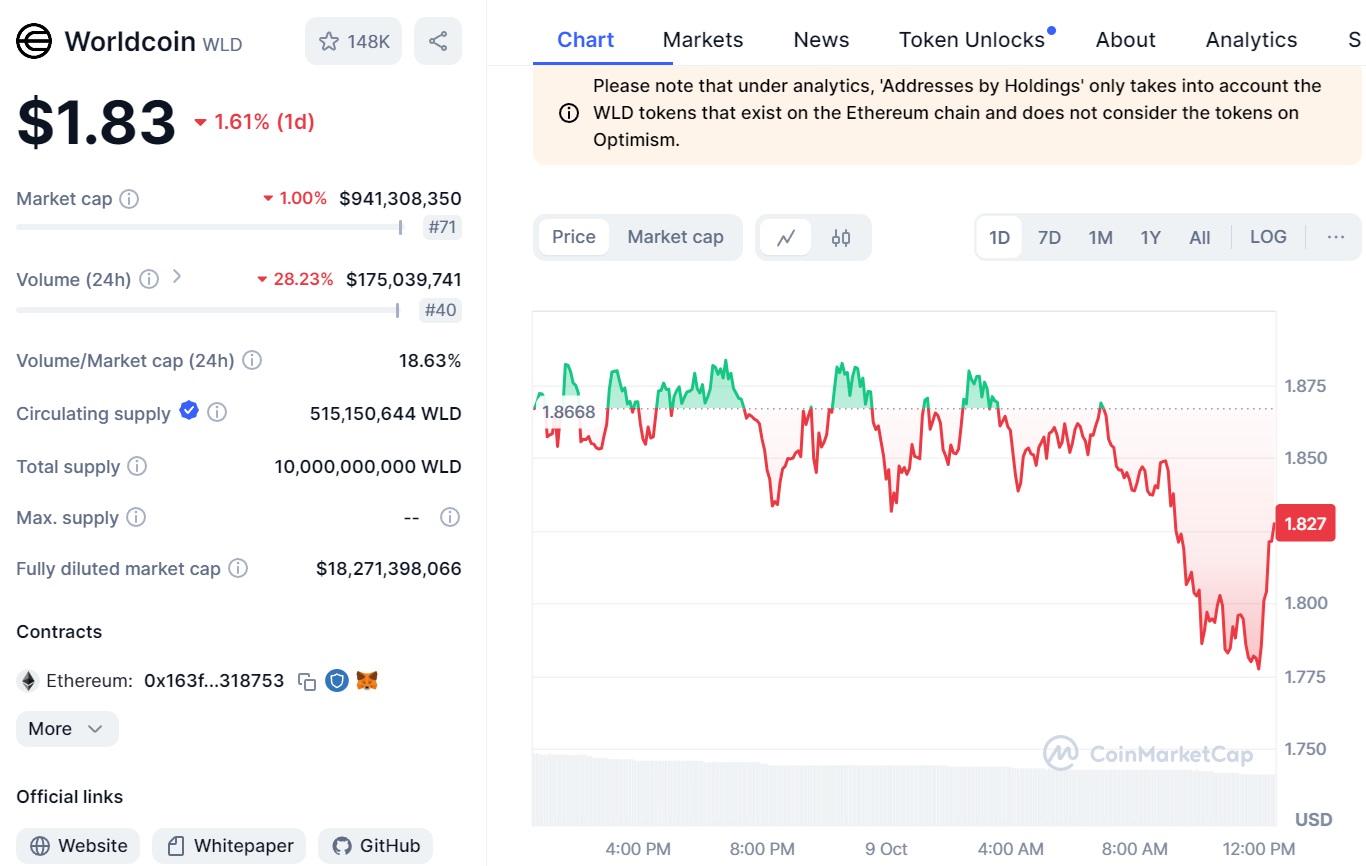

- The price of WLD has fallen by 1.6%, reaching $1.83, while trading volume decreases by 28.2%, evidencing a marked disinterest among investors.

- Some analysts speculate about a possible rebound in the price of WLD, driven by Microsoft’s potential acquisition of OpenAI.

Worldcoin (WLD), an AI token, is facing significant selling pressure following the massive liquidations by Alameda Research.

The firm, recognized in the market as a major liquidity provider, has been offloading large volumes of WLD on the Binance platform, causing concern among investors in the token.

Alameda Research has been depositing 143,770 $WLD (now $265K) to Binance weekly for the past 2 months!

Since August 9, they’ve deposited 1.56M $WLD ($2.51M) to #Binance in 10 batches at an average price of $1.605, leaving 23.44M $WLD ($43M) remaining. At this rate, it could take… https://t.co/k0qLuZiGr9 pic.twitter.com/jqgzCBylWO

— Spot On Chain (@spotonchain) October 9, 2024

Recent on-chain data indicates that, over the past few weeks, Alameda has been selling around 143,770 Worldcoin tokens weekly. Since August 9, the company has disposed of a total of 1.56 million tokens, worth approximately $2.51 million, in ten separate transactions with an average deposit price of $1.605 per token.

Bad Day for Worldcoin (WLD)

As selling pressure increases, the price of WLD has experienced a decline of nearly 1.6% in intraday trading, reaching a value of $1.83. Over the past 24 hours, the price of the token fluctuated between $1.77 and $1.89, evidencing extreme volatility. Additionally, trading volume has decreased by 28.2%, hovering around $175 million.

The continuous sales by Alameda Research have generated a negative sentiment, leading investors to question the future of Worldcoin. Moreover, Coinglass data has shown a 10% drop in WLD’s open interest in futures, which now stands at $170.83 million. The volume of derivative trades has also decreased by 31%, falling to $754.13 million, indicating a marked disinterest from investors.

A Possible Rebound with Microsoft’s Help

Despite this unfavorable context, some analysts suggest that there is a possibility of a rebound in the price of WLD. Recently, speculation has arisen around a potential acquisition of OpenAI by Microsoft, which could benefit Worldcoin and reactivate its price.

However, the situation with Alameda Research also raises other concerns. Currently, the firm holds 23.44 million WLD tokens, valued at approximately $43 million. Liquidating these remaining holdings could prolong downward pressure on the price of WLD, with estimates suggesting that this process could extend over the next three years