It’s already here and meant to stay – AI has infiltrated many aspects of our lives already, whether we realize it or not. What you see, read, and listen to on the internet might very well not be the work of a human, but what if we go further into a more sensitive area? What if an AI not only curated your content and wrote tedious emails for you, but also seamlessly handled your finances?

The finance industry is pouring money into AI, with spending expected to surge in the coming years. In 2023 alone, financial institutions invested an estimated 35 billion U.S. dollars in this technology. You might not ‘feel’ this investment when using your banking app, but there’s no doubt those billions will drip down, affecting even the smallest transactions.

The only questions about AI’s contribution are how disruptive it will be to our lives, how much ‘trust’ you should place in the machine’s judgment, and how you can get the most out of it. We’ll touch on all of these questions shortly in this article.

No Emotion, No Bias, More Data

The year was 2000, Windows XP was still in the making, and only the tech-savvy owned a Nokia, yet studies showed that 39 of the top 100 banks already offered fully functional Internet banking. Just a few years later, the number was 100% as the market forced industry actors to catch up with the first mover to act.

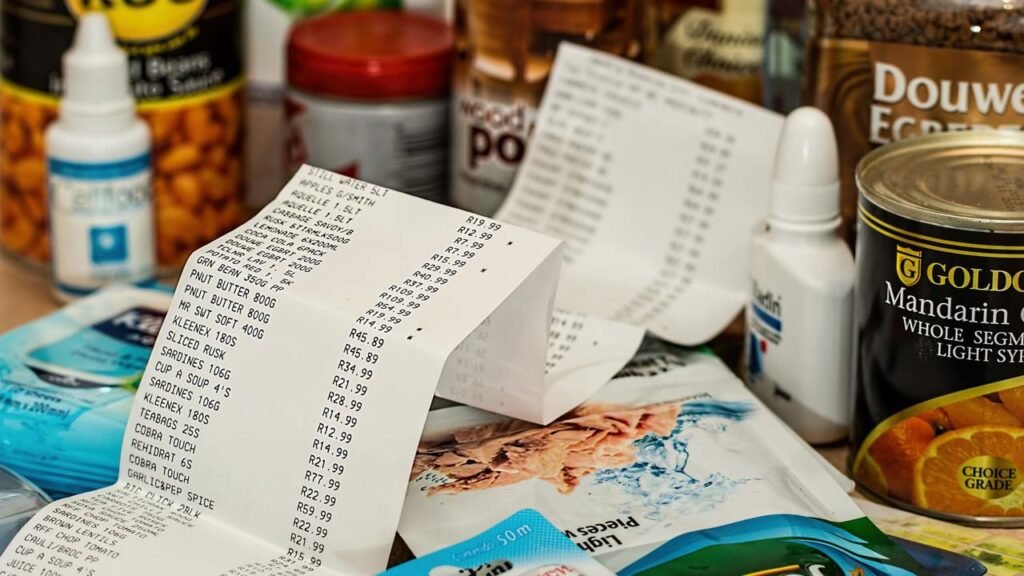

In the smartphone era, you would never choose a bank that doesn’t have an app because it makes your life easier just that easier when handling your live budget and lets you send and receive money with a few taps. We could have a similar user experience with some AI finance delegator, where it organizes your monthly finances and decides instead of you how you’re going to spend money on needed things like groceries and utility bills, is there any way of cutting down the expanses, or could let yourself a bit more breathing air to visit a Michelin starred restaurant or visit https://fatfruitcasino.com/ for a round of Blackjack. In the latter example, online casino platforms would most likely have cool-off period settings to avoid abuse, which casinos usually have to begin with, but feature redundancy is always appreciated at the native level.

Either way, no financial institution would thrive without a digital solution, and arguably, soon, we will start picking the bank with the best AI, but beyond the ordinary and mundane choice of where to open an account, what’s AI currently capable of doing is still unknown in the world of regular users.

High-End Finance Is Now More Accessible

Financial models and forecasts take many working hours from the minds of highly paid experts to build. Imagine an AI that can do that for your small and mid-sized business for much, much cheaper.

Openbox’s co-founder and CEO said the company is set to launch an AI-powered financial modeling sidekick: ‘Now organizations of all sizes can benefit from advantages normally only available to larger corporates.’ The financial aspect of your business plan won’t be a chore or a choke point of your pitch deck anymore, and Saas Revenue forecasting will take minutes, not days.

In the investment world, AI models are scrapping social media and everything online to make investment decisions, with predictions coming in for any scenario. If that tech is made available to anyone and admin work is settled by a machine acting as an entire financial department, your attention and time would focus on other important areas, whether you run an actual business or want to manage your budget better.

Reading through all this and considering that an analytical mind is needed in finance and emotions are often seen as obstacles, why wouldn’t a machine maker make better financial decisions than a human? It seems as if the answer is apparent, but when you look back to the AI ‘predecessors,’ the internet, questions pop up.

Are We Educated Enough to Use It?

It’s a well-accepted fact that technology develops faster than our institutions can adapt. It’s been over ten years, and we arguably still don’t know where to put cryptocurrency and what’s right or wrong about it. There have been thousands of success stories, but even more horror ones that destroyed the finances of millions.

Related Posts

Drifting back to AI, the lack of regulation can be felt directly in creative industries. There are countless cases in which artists’ work is being ‘stolen’ by AI image generator models, and no royalties are paid.

The point goes beyond attribution of creatives; it concerns how safe your financial data is if a well-trained model scrapes Internet data without restriction. Rules, laws, and systems are yet to be set for that and for what the limit to AI is.

An unimaginable amount of data flows daily to keep your finances active and safe. And if there’s data, there is and will be an AI that processes it; considering how many data scandals we have had this year only, there’s much more work to do before a green light on AI is given worldwide.

There Are Still Limitation

Imagine asking the chat GPT of finances, ‘I have 1000$ I want to invest in. Can you guide me towards the best options with the lowest risk and fastest return?’

If you do that today on the real text model, you’ll receive some general tips and a warning message that it’s best to ask an expert. Trading bots have tried to automate, but results show they’re no better than sharp human instincts. Why? Because it’s only you using the bot or the AI – if it’s available to anyone, then everyone will use it.

Going back to the pre-internet era, tech allowed for everything to be faster and smoother, but financial crises were not avoided compared to previous decades and only became more common. The more we tried to put the future in control, the further it evaded us.

Arguably, AI’s ultimate role in finance would be to predict the future—yet history has taught us that that is not a good game to play.

True Value Lies In Scarcity

Now we know that everyone will have their personal assistant and companies the super AI’s, so what will make the difference between making a good, bad, or special financial decision? The answer is simple: it’s you!

Financial models rely on historical data, industry benchmarks, and informed assumptions. The analyst must identify the most relevant data sources to ensure the model reflects reality. An AI is a tool that does the same for everyone, yet the one factor that changes is human input, which will define the result and your success, whatever your financial goal is.

There’s Still Time To Catch Up

Unlike most trends, we are not too late; we have not even started. We are yet to experience the true power of AI in finance. But what you do now might define your success after when the virtual assistants.

Keeping updated is crucial; using the latest means that tech can provide even more to stay relevant, but giving up on lessons from the past for the thrill of new technology and the promise of a new salutation that will do everything for you is not wise.

A machine will do the heavy lifting, but the next great decision will likely not be about who leaves the best and fastest AI in autoplay but about who has the greatest insight into the force that turns the financial system—human behavior.