- SUI has surged 115% in the past 30 days, reaching $1.69 and nearing its all-time high.

- Memecoins in the SUI ecosystem have driven the rally, with some seeing triple-digit gains in recent weeks.

The SUI token has witnessed a significant price rally, climbing 115% over the last 30 days and reaching a six-month high. SUI reached $1.69 on October 4th, having increased by 170% from a low of $0. 742 on September 2. SUI is now trading at only 8. 8% below the record $2.18 it hit on March 27.

SUI was among the best-performing cryptocurrencies, as its market capital increased compared to the general increase of 4.4% for the cryptocurrency market capital and 7.3% for Bitcoin (BTC) during the same thirty-day period. According to data, SUI is now the second-highest gainer among the top 100 cryptocurrencies by market cap for the last 30 days.

Memecoins on SUI Network Drive Token’s Explosive Growth

The rapid expansion of memecoins within its blockchain has greatly contributed to the current upsurge in SUI prices. Memecoins on the SUI network have outperformed the broader crypto market, with several posting impressive gains. Over the past 24 days, the total market capitalization of memecoins on the SUI network has increased by 15%, reaching $256.3 million on October 4, according to CoinGecko.

One standout performer is Aaa cat (AAA), which saw a 430% increase in the past week and a 16% rise in the last 24 hours. Similarly, Suiba Inu (SUIB) added 108% over the week and an additional 7% in 24 hours. Sudeng (HIPPO), the SUI’s largest memecoin in terms of market cap, saw its value surge by around 35%, driving its market capitalization to $126. 4 million. The memecoin trend has not only been isolated to SUI but has also seen traction on other blockchains like Solana, Base, and The Open Network (TON).

SUI Network Activity Surges Across Multiple Metrics

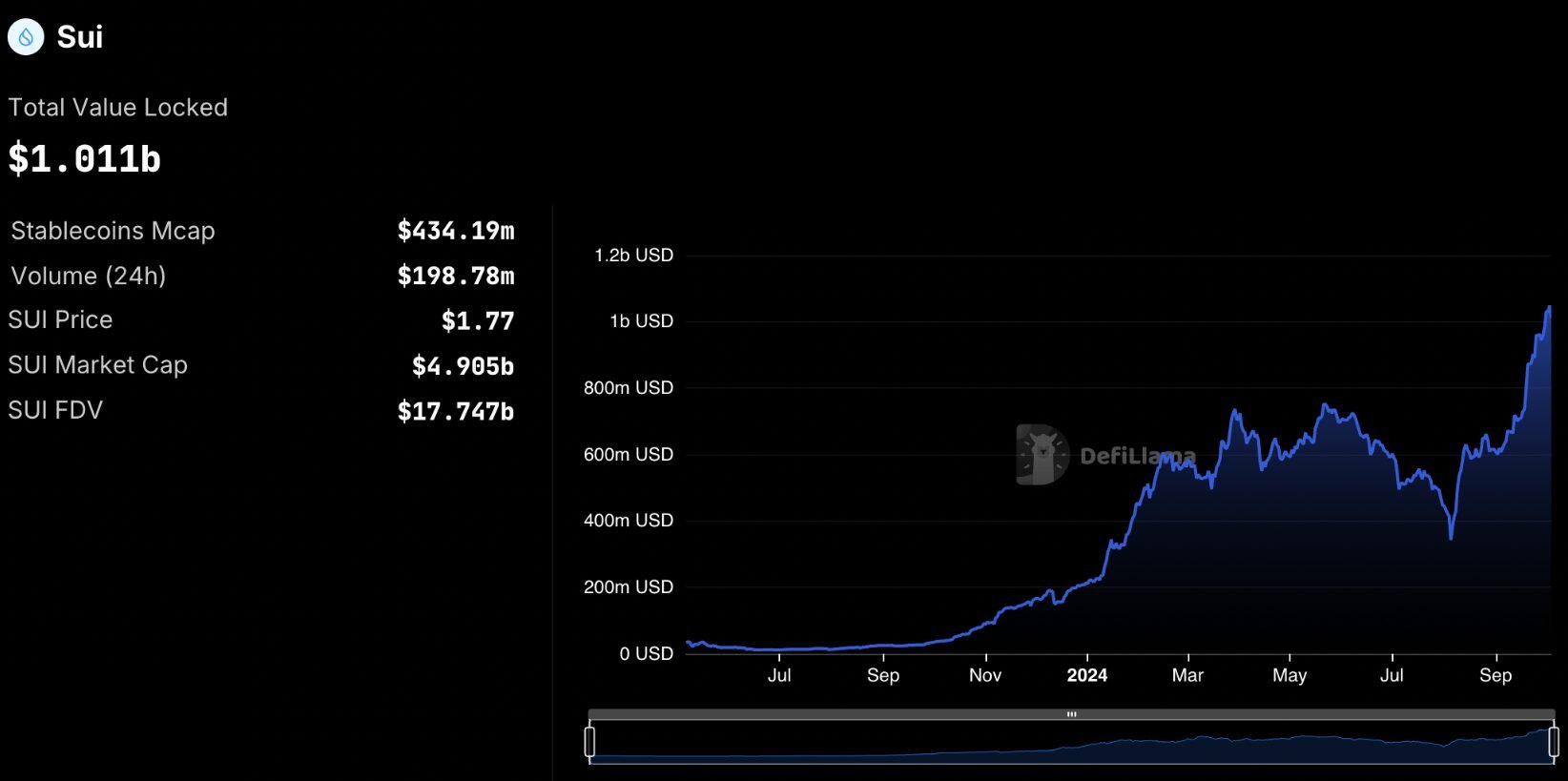

The rise in token value can also be attributed to the increasing operations within the Sui blockchain. Transaction volume, development activity, and total value locked (TVL) on the network have sharply increased. According to DefiLlama, the transaction volume of SUI increased by 661%, moving from $26.1 million on September 4 to $198.7 million on October 3. It is not far from the record high level of $219 million that was noted on March 26th for this case.

There was also a significant increase in the overall transactions within the Sui network. According to SuiScan, more than 16.7 million extra transactions occurred within 24 hours, totaling 2.02 billion. This surge in activity indicates growing user interest and engagement with the Sui ecosystem.

In addition, the total value locked (TVL) on the Sui network rose 63% to $1 billion by October 4th from $620 million recorded a month earlier. Normally, when the TVL is high, many users interact with the platform and trust it. This may increase demand for the native token and increase its price even more.

While Sui’s recent price movements have drawn attention, market analysts remain divided on the token’s future. Some experts predict that Sui could experience a short-term correction, potentially pulling back to around $1.4, though a drop back to $1 is unlikely.

On the other hand, Sui’s strong fundamentals have led many analysts to expect continued growth. The token is currently testing a major resistance level, and a further price increase will likely follow if it breaks through.