TL;DR

- The crypto market fell by 5% following Middle East tensions, with $450 million in liquidations.

- Bitcoin reached $60,300 before partially recovering to $61,247, reflecting a daily loss of 4.1%.

- Despite massive liquidations, some analysts remain confident that BTC could reach $70,000 in the coming weeks.

The cryptocurrency market suffered a sharp decline following the increase in geopolitical tensions in the Middle East, resulting in the liquidation of approximately $450 million in bullish bets. The total market capitalization dropped by an average of 5%, affecting major digital assets like Bitcoin and Ethereum.

The plunge occurred after Iran launched missiles toward strategic locations in Israel, sparking uncertainty in global markets and affecting risk assets, including BTC. The leading cryptocurrency fell to $60,300, its lowest level this month, before slightly recovering during Asian trading hours. It is currently trading at $61,247, reflecting a daily loss of 4.1%.

A Major Setback for the Bullish Crypto Market

Data from CoinGlass reveals that the vast majority of traders, 86%, held bullish positions at the beginning of October, confident that this historically favorable month for Bitcoin would follow the trend.

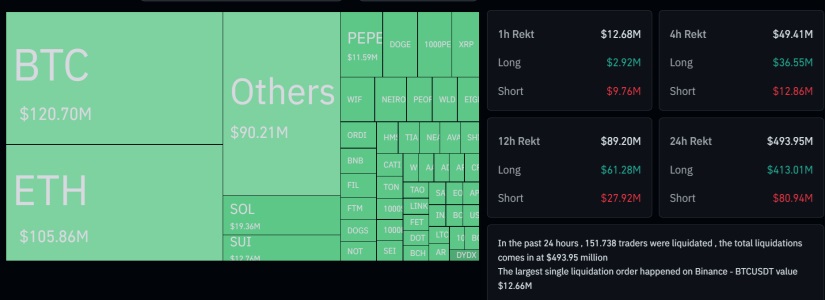

However, the market’s downturn took many investors by surprise, triggering massive liquidations in futures contracts of several major tokens. Traders betting on BTC price increases saw losses exceeding $101 million, while Ethereum bets resulted in liquidations close to $92 million. Altcoins also suffered significant losses, with liquidations totaling over $85 million, and PEPE being one of the hardest hit with $10 million in liquidations.

Hope Remains for Bitcoin

The impact of these liquidations reflects extreme market behavior. In situations like this, sharp movements can indicate an overselling or overbuying response due to investor panic.

Despite the sharp decline, many analysts believe that October could continue to favor Bitcoin, given that it has had only two negative months since 2013. Some traders remain hopeful that BTC’s price could recover and reach $70,000 in the coming weeks, driven by factors such as global monetary policies and political support in the United States that have favored the bullish trend in recent weeks