US aids Israel as Iran prepares for missile attack.

Key Takeaways

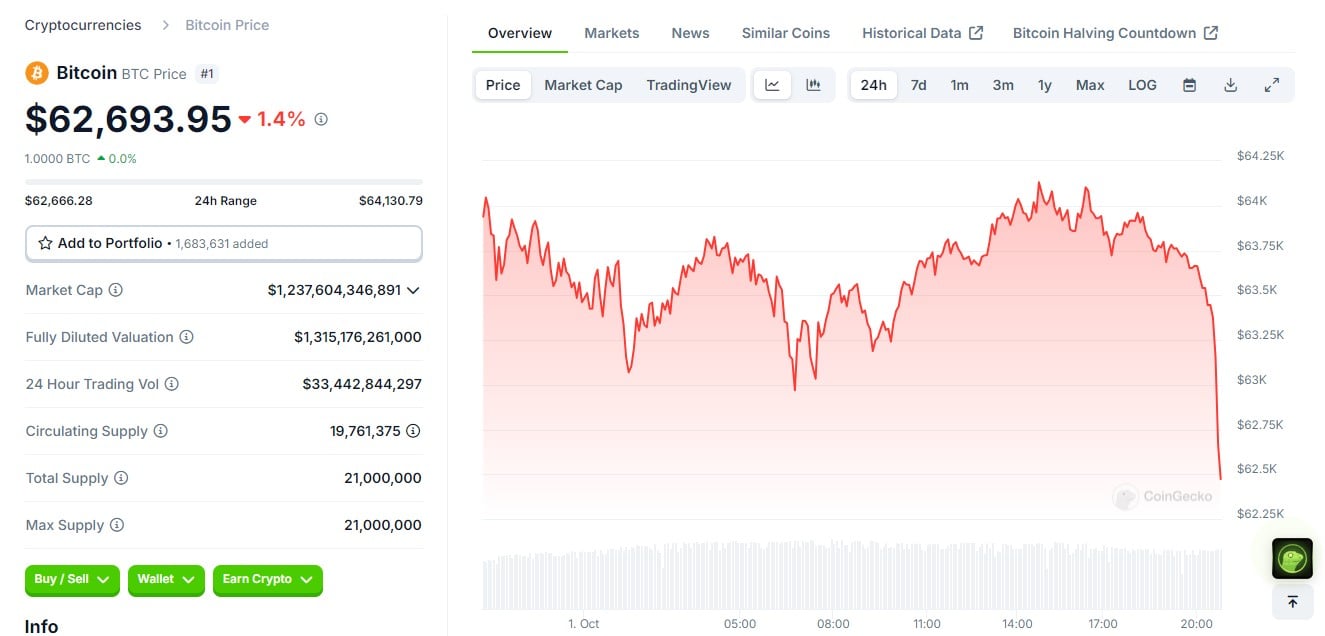

- Bitcoin’s price fell below $62,500 amid news of an imminent Iranian missile attack on Israel.

- Geopolitical unrest, like the Iran-Israel conflict, influences Bitcoin’s market value.

Share this article

Bitcoin’s value plummeted below $62,500 on Tuesday morning briefly after reports of Iran’s impending missile strike on Israel broke, CoinGecko data shows. At the time of reporting, BTC was trading at around $62,800, down 1.4% in the last 24 hours.

The situation is escalating rapidly in the Middle East. The US has detected preparations by Iran for a ballistic missile attack aimed at Israel, a senior White House official disclosed today. The official, who preferred anonymity, added that the US is assisting Israel in defense preparations against this potential assault, which could provoke severe repercussions for Iran.

The latest development comes amid escalating tensions between Israel and Iran-backed Hezbollah in Lebanon. Israeli forces have launched ground raids and airstrikes in southern Lebanon, targeting Hezbollah positions. In retaliation, Hezbollah has fired rockets into Israel, prompting widespread evacuations.

Bitcoin’s price tends to fluctuate in response to geopolitical unrest. Earlier in April, Bitcoin’s price fell below $60,000 after Israel launched a missile strike on Iran.

Other historical events, such as the US-China trade war and the Russia-Ukraine conflict, have also demonstrated Bitcoin’s volatility during geopolitical crises, with major price movements correlating to increased tensions.

The broader crypto market is under pressure as Bitcoin retreats. Ethereum fell below $2,600, down 2% in the last 24 hours while Binance Coin plunged toward $550. However, the market is still holding onto last week’s gains, suggesting that the recent dip may be a short-term pullback.

Share this article