TL;DR

- Cryptocurrency investment products have accumulated inflows of $1.2 billion over three consecutive weeks.

- The approval of investment options in the U.S. improves market sentiment, despite a decline in trading volumes.

- Ethereum experiences positive inflows after five weeks of losses, while Solana suffered outflows.

In the last week, cryptocurrency investment products recorded inflows reaching $1.2 billion, marking the third consecutive week of inflows.

The increase in inflows is attributed to expectations of a more dovish monetary policy in the United States, creating a positive environment for the crypto market. Despite the optimism, trading volumes have shown a slight decrease of 3.1% compared to the previous week, indicating that while interest in investing is increasing, active transactions have not kept pace.

The recent boost in inflows was supported by the approval of options for certain investment products in the U.S. However, the improvement in interest in crypto assets has not translated into an equivalent increase in trading volumes.

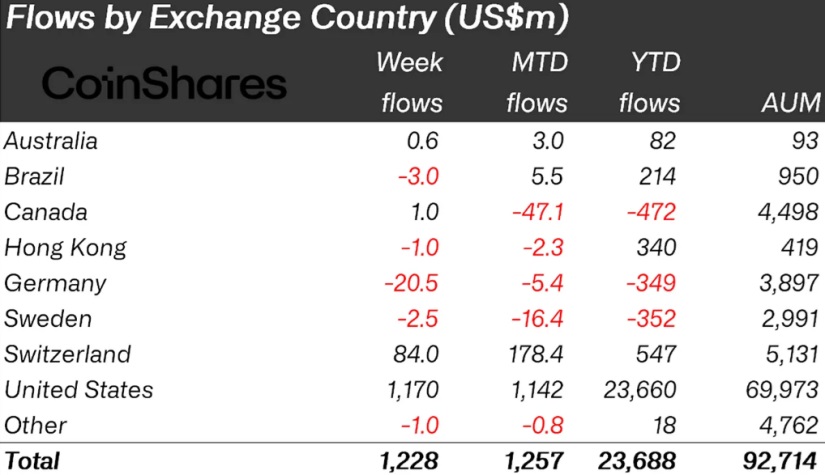

Regionally, the situation varies: the United States and Switzerland reported inflows of $1.2 billion and $84 million, respectively. The latter figure represents the highest level recorded since mid-2022. In contrast, countries like Germany and Brazil experienced outflows, with losses of $21 million and $3 million, respectively.

Ambiguous Performance for Various Cryptos

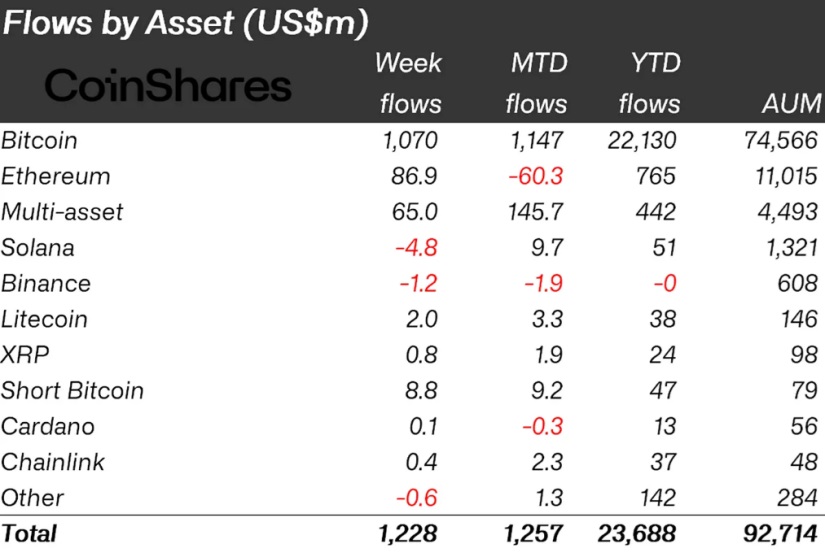

In terms of performance, Bitcoin (BTC) led the inflow table with $1 billion, which also boosted inflows into short-term investment products, totaling $8.8 million.

Meanwhile, Ethereum (ETH) managed to reverse its five-week negative trend, accumulating significant inflows of $87 million, marking the first significant inflow since early August. However, Solana (SOL) faced outflows of $4.8 million.

The results were varied among altcoins. Litecoin (LTC) and XRP (XRP) saw inflows of $2 million and $0.8 million, while Binance (BNC) and Stacks (STX) faced significant outflows of $1.2 million and $0.9 million, respectively.