All eyes have been on the bogus intelligence (AI) market over the past yr. The launch of OpenAI’s ChatGPT on the finish of 2022 reinvigorated curiosity within the know-how and compelled many to rethink what they thought was presently attainable with AI. Advances within the generative software program may enhance numerous industries, from self-driving automobiles to e-commerce, client merchandise, cloud computing, and extra.

A increase in AI has been a vital development driver within the Nasdaq-100 Technology Sector‘s 33% rise over the past 12 months. Dozens of AI-driven tech firms have loved stable positive factors due to AI. However, the market seems to be nowhere close to hitting its ceiling, suggesting it isn’t too late to make a long-term funding within the trade.

Chip shares like Nvidia (NASDAQ: NVDA) and Intel (NASDAQ: INTC) are engaging choices, with each firms growing the {hardware} that makes AI attainable. These tech giants may have a lot to supply buyers within the coming years as chip demand rises and the AI market develops.

Here are two AI shares to purchase and maintain for excellent long-term potential.

1. Nvidia

Shares in Nvidia have soared greater than 210% since final June. The firm has rallied buyers by attaining a number one market share in AI graphics processing items (GPUs), the chips used to run and prepare AI fashions.

As a outcome, Nvidia’s inventory is buying and selling at a premium, with a ahead price-to-earnings (P/E) ratio of about 44. However, that determine would not essentially inform the entire story.

First, Nvidia’s ahead P/E is decrease than the identical metric for its greatest rival, Advanced Micro Devices, which has a ahead P/E of 48. The distinction signifies Nvidia’s inventory is buying and selling at a greater worth regardless of delivering considerably extra inventory development than AMD over the past yr.

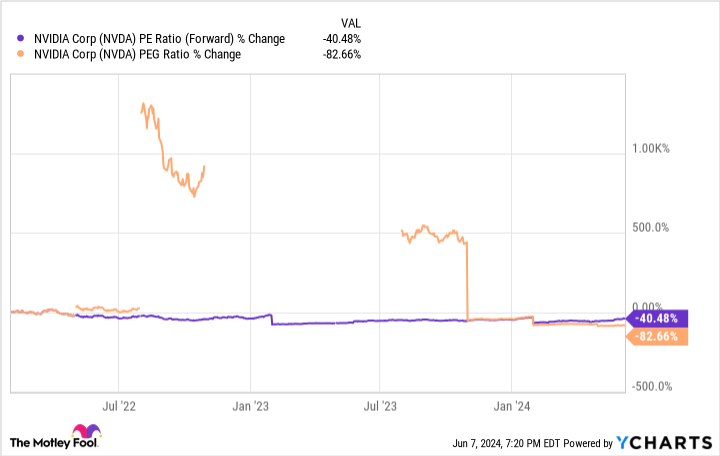

Additionally, even with Nvidia’s meteoric rise, the corporate’s inventory has truly elevated in worth since 2021. This chart exhibits Nvidia’s ahead P/E and value/earnings to development (PEG) ratio have plunged, indicating the corporate’s inventory could possibly be buying and selling at certainly one of its greatest values in years. Now could possibly be the very best time to put money into Nvidia.

However, it will likely be essential to method this inventory with a long-term mindset. Nvidia has delivered a number of quarters of report earnings, posting income development of 262% in its first quarter of fiscal 2025 (ending April 2024). Yet Nvidia’s excessive ahead P/E suggests a few of its projected monetary development may already be priced into its shares to some extent. But holding over a few years will doubtless mitigate this.

Nvidia has an estimated 70% to 95% market share in AI chips. The firm has develop into the go-to chip provider for AI builders worldwide, illustrating dominance that can doubtless show difficult for rivals like AMD to beat.

As a outcome, Nvidia may have far more to supply over the long run, and it stays an AI inventory value investing in proper now.

2. Intel

Intel’s inclusion on this record might need you questioning why it’s best to contemplate having two chipmakers in your portfolio. However, current restructuring means Intel operates in a vastly completely different a part of the chip market to Nvidia and will have equal, if no more, development potential than its AI friends.

While Nvidia is concentrated on chip design, Intel is transitioning its enterprise to a foundry mannequin. The firm has plans to construct chip manufacturing crops all through the U.S. So, as chip demand is hovering, Intel may develop into the nation’s go-to chip producer, benefiting from the whole AI market’s development.

In May, CEO Pat Gelsinger stated he expects Intel’s coming Ohio plant to develop into the “AI systems fab for the nation.” Gelsinger then reiterated the sentiment at a convention in Taipei on June 4, saying: “We want to build everybody’s chips, everybody’s AI chips. We want them to be built leveraging the U.S. factories.”

Intel goes full drive into manufacturing, which may considerably repay over the long run. However, a foundry mannequin is not low-cost and requires heavy funding upfront, which is why most tech firms favor to outsource their manufacturing. As a outcome, it is going to take time for Intel to see a return on its funding.

However, with a ahead P/E of 28, Intel is doubtlessly one of many best-valued shares in AI. The firm’s ahead P/E is significantly decrease than fellow chipmakers AMD or Nvidia, suggesting that now is a superb time to make a long-term funding in Intel.

Should you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Fool Stock Advisor analyst workforce simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Nvidia wasn’t certainly one of them. The 10 shares that made the lower may produce monster returns within the coming years.

Consider when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $740,690!*

Stock Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Stock Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Dani Cook has no place in any of the shares talked about. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and brief August 2024 $35 calls on Intel. The Motley Fool has a disclosure coverage.

2 Artificial Intelligence (AI) Stocks to Buy and Hold for Great Long-Term Potential was initially printed by The Motley Fool

MoneyMaker FX EA Trading Robot

powered by qhost365.com

Finance.yahoo.com