Article content material

(Bloomberg) — Gold’s record-setting rally could have captured the headlines this 12 months, but it surely’s silver that’s operating more durable and quicker because the much less glamorous steel advantages from strong monetary and industrial demand.

Silver has soared by virtually 1 / 4 in 2024, outpacing gold and making it one of many 12 months’s best-performing main commodities. Yet in relative phrases, silver remains to be low cost. It presently takes about 80 ounces of silver to purchase 1 ounce of gold, in contrast with the 20-year common of 68.

Article content material

The two metals transfer largely in tandem as each supply related macro- and currency-hedging properties. With gold hitting a file on central-bank shopping for, retail curiosity in China, and a resurgence in bets decrease US rates of interest are on the best way, silver’s gone alongside for the experience. Although there’s been scant curiosity from traders in silver-backed exchange-traded funds, bodily gross sales have picked up, together with at Singapore-based seller Silver Bullion Pte.

“Even clients who are interested in buying gold are starting to say ‘well, maybe I’ll buy silver first, and wait for the ratio to sort of rebalance’,” stated founder Gregor Gregersen. Between April 1 and 25, the outlet offered 74 ounces of bodily silver for every ounce of gold, in contrast with a median of 44 in 2023.

The white steel has already been making headway in opposition to its dearer cousin, in relative phrases. Back in January, the gold-silver ratio was above 90, probably the most stretched since September 2022. Citigroup Inc. reckons that if the Federal Reserve proceeds with interest-rate cuts and financial progress stays robust within the second half, the ratio might transfer to round 70, though it cautioned {that a} slowdown would push it the opposite method, in keeping with a be aware.

Article content material

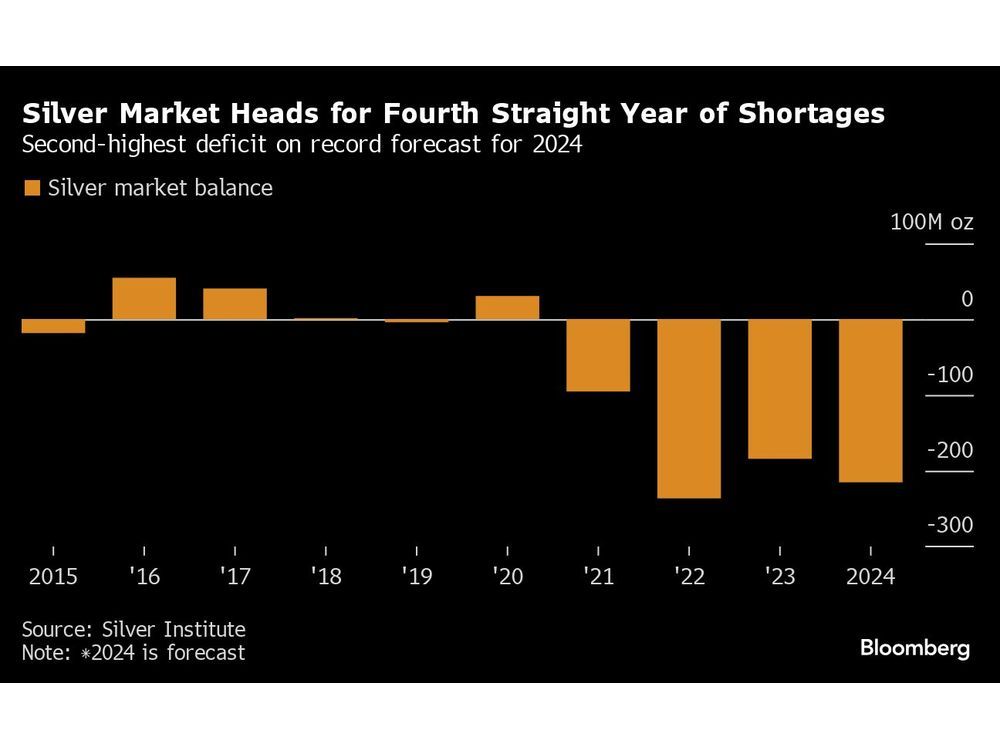

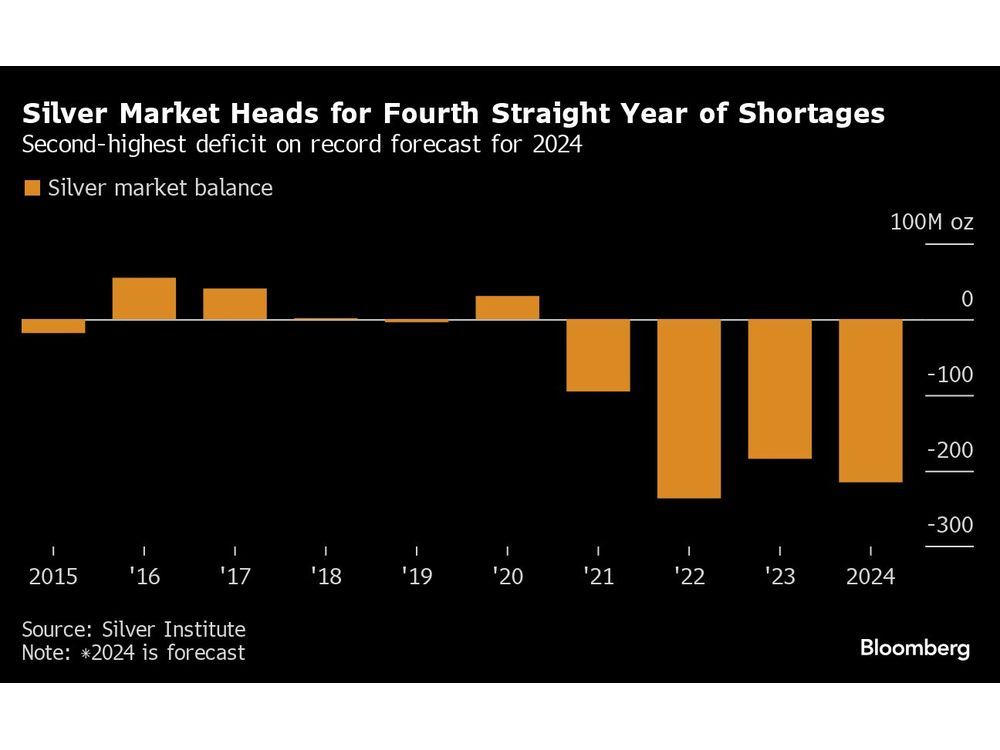

Silver has a twin character, valued each for its makes use of as a monetary asset and an industrial enter, together with clean-energy applied sciences. The steel is a key ingredient in photo voltaic panels, and with strong progress in that trade, utilization of the steel is predicted to succeed in a file this 12 months, in keeping with the Silver Institute. Against that backdrop, the market is headed for a fourth 12 months in deficit, with this 12 months’s scarcity seen because the second greatest on file.

That’s led industrial customers – which usually depend on miners for provide – to hunt ounces by draining the world’s main inventories, in keeping with Silver Bullion’s Gregersen. Stockpiles tracked by the London Bullion Market Association fell to the second-lowest stage on file in April, whereas the volumes at exchanges in New York and Shanghai are close to seasonal lows.

Over the subsequent two years, the LBMA stockpiles could also be depleted given the present tempo of demand, in keeping with TD Securities. The headline determine overstates the accessible quantity of steel provided that it contains exchange-traded fund holdings, Daniel Ghali, a commodity strategist, stated in an April be aware.

“We are slowly going to see supplies tightening because industrial demand is set to go higher,” Gregersen stated. “If investors are also starting to buy, then I think in two or three months’ time, my biggest problem might end up being ‘Where do I find supply?’ rather than ‘How do I sell the silver?’”

Share this text in your social community

MoneyMaker FX EA Trading Robot

powered by qhost365.com

Financialpost.com