PayPal Holdings (NASDAQ: PYPL) is struggling, and one would not must go far to search out examples.

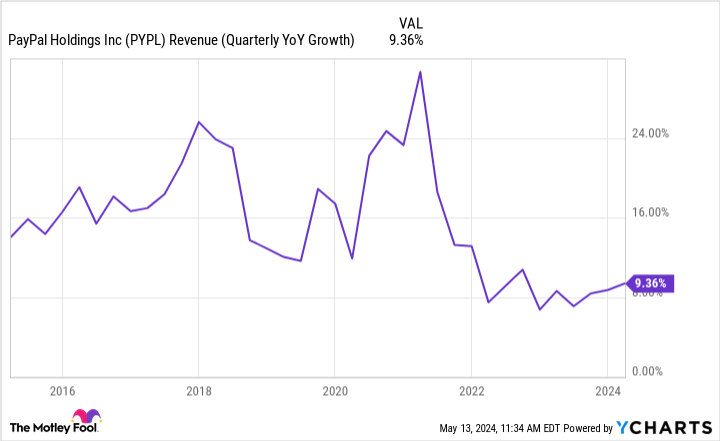

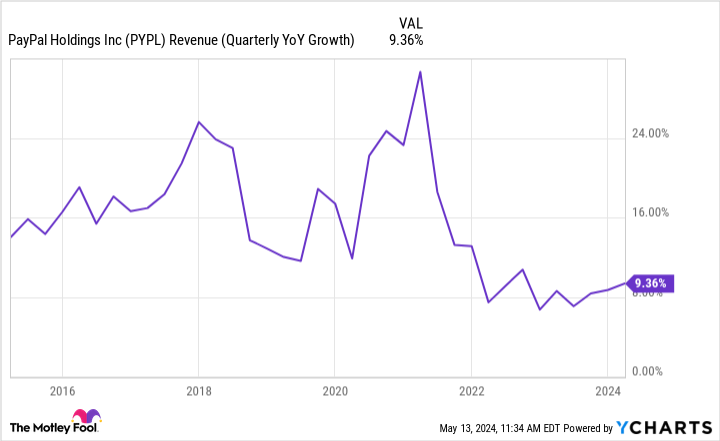

For starters, for years PayPal’s prime line elevated at a double-digit share charge. But for the previous couple of years its development charge has been far more pedestrian, with the corporate’s income solely growing by 9% in the latest quarter.

Growth has slowed for PayPal. And here is one other battle for the corporate: The development that it does have is of lesser high quality. Much of its development has come from its unbranded checkout resolution, which powers some platforms behind the scenes. This has a decrease revenue margin. So whereas its total income is up, its revenue has barely moved.

PayPal has struggles. But new Chief Executive Officer Alex Chriss is trying previous a few of them to its Venmo enterprise, the place there’s one metric that is greater than only a battle — Chriss finds this statistic merely unacceptable.

What’s unsuitable with PayPal’s Venmo?

Venmo is peer-to-peer monetary expertise (fintech). With the cellular app, customers can join and ship cash backwards and forwards, usually to separate the price of a meal or comparable group exercise.

In the earnings name to debate monetary outcomes for the primary quarter of 2024, here is what Chriss needed to say: “There’s $18 billion of net new funds that flow into the platform of Venmo every single month. Eighty percent of those dollars leave within 10 days. That is just unacceptable.”

PayPal’s administration apparently desires its customers to pay for issues from their Venmo accounts, not switch balances to different monetary establishments to pay from there. The inferred motive for that is that banks make straightforward cash off of buyer balances. But that is exactly why it could be laborious to influence folks to maintain funds in Venmo.

First, Venmo is not a financial institution, and would not include the identical ensures that conventional financial institution accounts do. Second, financial institution accounts earn curiosity — not a lot, however no less than it is one thing. By distinction, cash in Venmo would not earn something. In quick, there isn’t any motive to maintain a Venmo steadiness. In truth, it is surprising to me that Chriss says that 20% of the cash really does sit there.

What’s the plan?

Before investing in PayPal inventory, one ought to know what the corporate owns and the way it matches into the larger image. In this case, Venmo accounts for 17% of PayPal’s whole enterprise from a fee quantity perspective as of Q1. And the platform has 60 million month-to-month lively customers — not inconsequential.

Both the PayPal platform and the Venmo platform principally handle the identical aspect of the fintech ecosystem: customers, not companies. I’ve famous that Chriss desires customers to pay for issues from Venmo, however the identical might be stated for PayPal’s core platform as effectively. To stimulate this, the corporate is pushing its debit card, which permits the digital-first firm to course of transactions offline — that is a part of Chriss’s plan to take care of what he finds unacceptable for Venmo.

Growth is encouraging for each platforms on this respect. In Q1, solely about 4% of PayPal’s accounts used the accompanying debit card. But first-time debit card customers had been up 38% yr over yr. Over on Venmo, there was a 21% enhance in debit card customers.

What now?

There are some encouraging indicators with Venmo, however PayPal is dealing with an uphill climb to get extra funds to remain on the platform as an alternative of being transferred elsewhere. Investors ought to watch debit-card penetration in upcoming quarters since this can be a level of emphasis from administration. Increased debit card utilization may result in higher monetization of Venmo.

That stated, PayPal continues to be the dominant a part of this enterprise, and administration has stated that 2024 will likely be a “transition year.” This signifies that total monetary outcomes might take time to indicate enchancment, giving buyers loads of time to calmly consider PayPal’s progress with Venmo for now.

Should you make investments $1,000 in PayPal proper now?

Before you purchase inventory in PayPal, contemplate this:

The Motley Fool Stock Advisor analyst staff simply recognized what they consider are the 10 finest shares for buyers to purchase now… and PayPal wasn’t considered one of them. The 10 shares that made the minimize may produce monster returns within the coming years.

Consider when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $553,880!*

Stock Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Stock Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Jon Quast has no place in any of the shares talked about. The Motley Fool has positions in and recommends PayPal. The Motley Fool recommends the next choices: quick June 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure coverage.

PayPal Is Struggling: Here’s What Its New CEO Finds “Unacceptable” was initially printed by The Motley Fool

MoneyMaker FX EA Trading Robot

powered by qhost365.com

Finance.yahoo.com