Stay knowledgeable with free updates

Simply signal as much as the Global Economy myFT Digest — delivered on to your inbox.

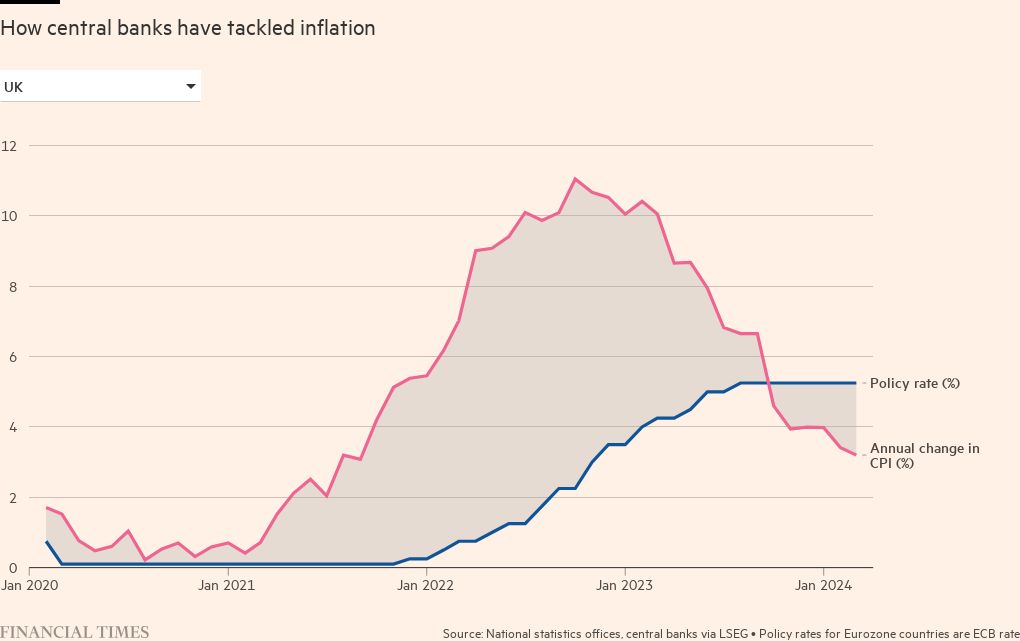

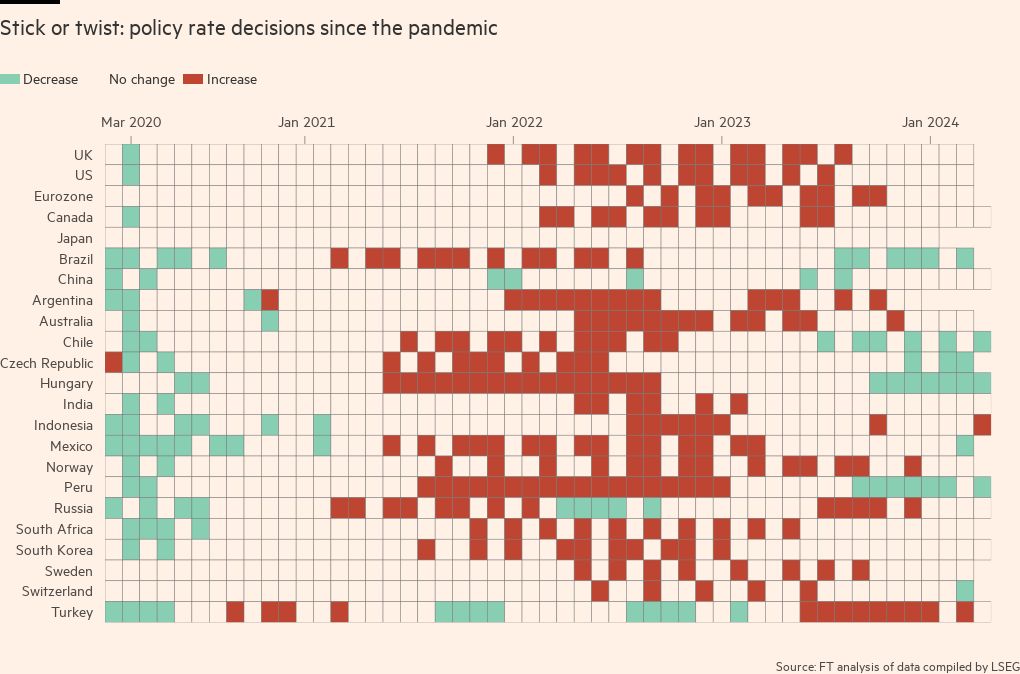

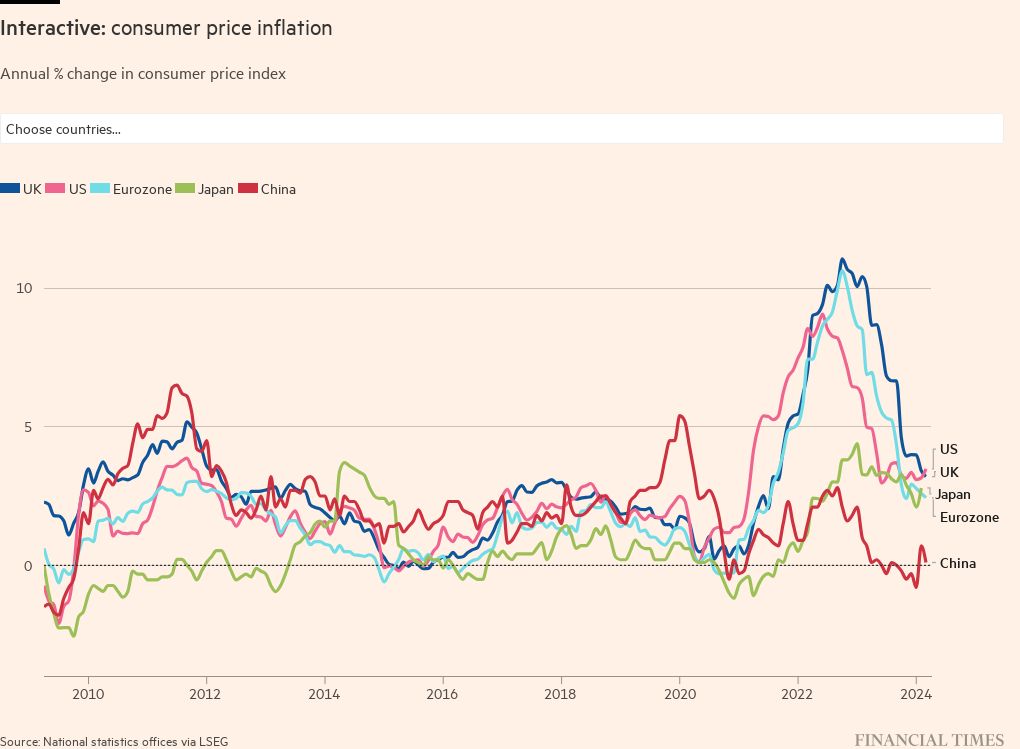

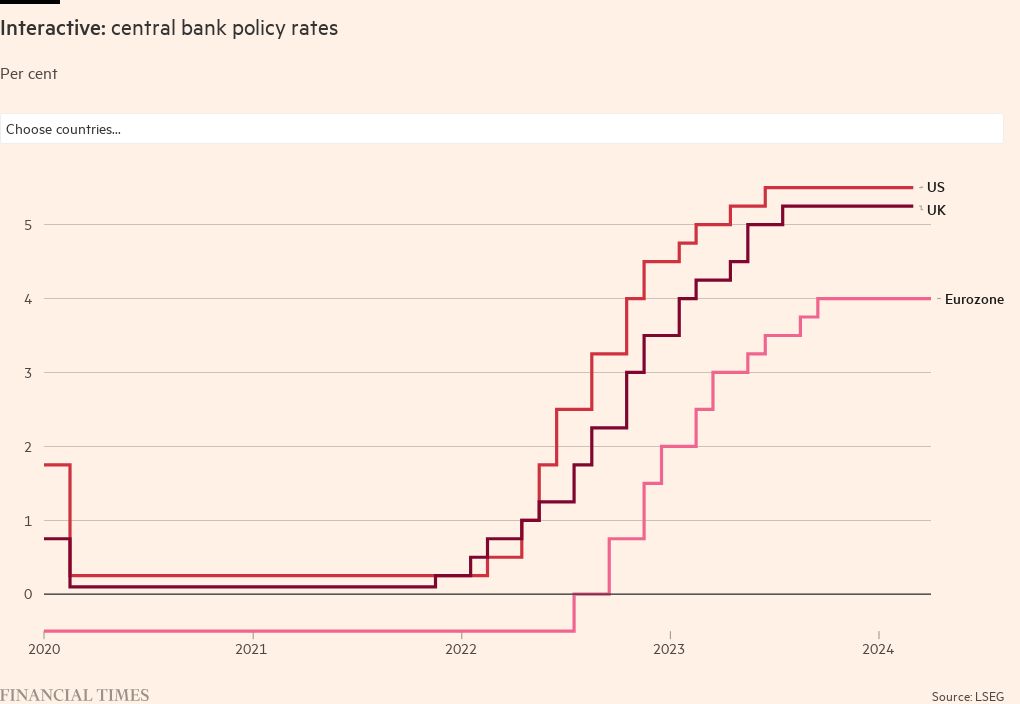

Central banks world wide are anticipated to decrease borrowing prices as international inflation eases from the multi-decade highs reached in lots of international locations over the previous two years.

Some establishments, notably in rising markets, have already began reducing charges, however many extra are forecast to comply with this yr, together with the US Federal Reserve, the European Central Bank and the Bank of England.

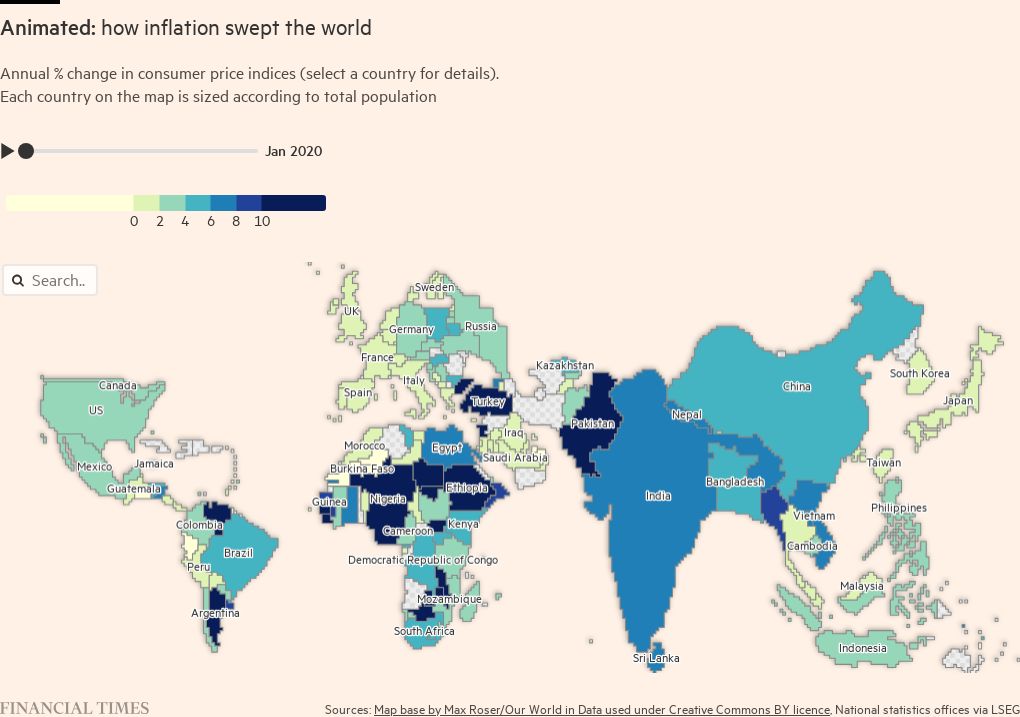

The FT international inflation and rates of interest tracker supplies a commonly up to date visible narrative of client worth inflation and central financial institution coverage charges world wide.

This web page covers the elements affecting policymakers’ selections on borrowing prices, displaying how central banks responded to rising costs with a synchronised improve in rates of interest.

Higher borrowing prices have helped ease the quick tempo of worth development that swept the world over the previous three years through the pandemic and conflict in Ukraine.

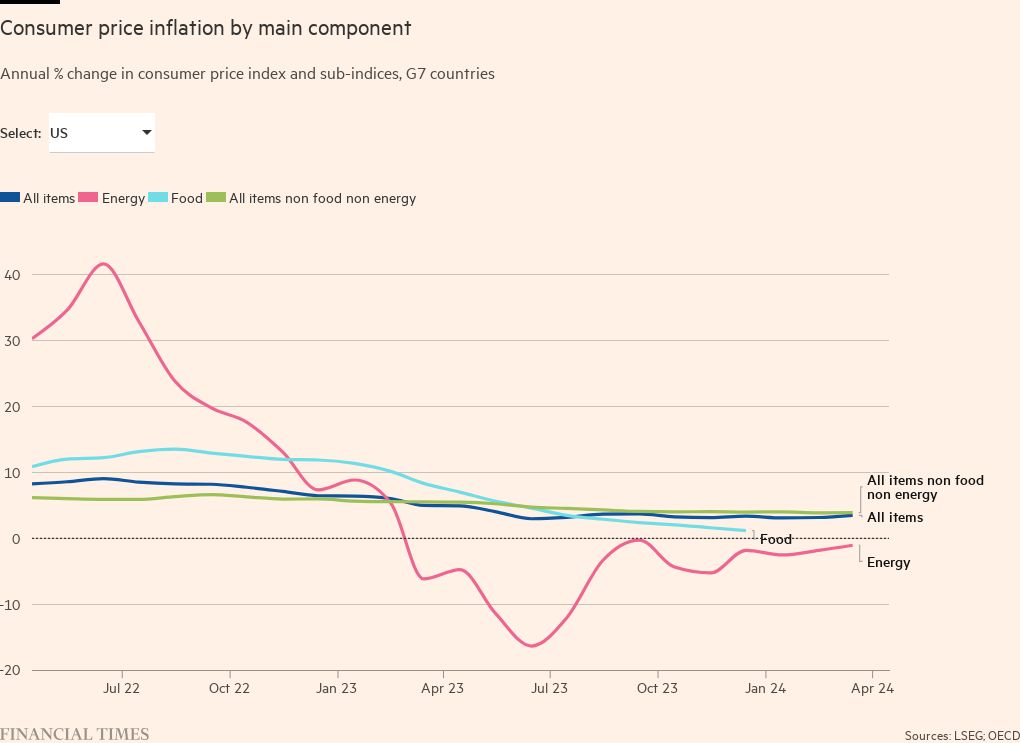

While inflation in most nations has come down from its peak, many policymakers have warned that the final leg of the journey to central banks’ goal — which in most superior economies is 2 per cent — would be the hardest.

You can use this web page to observe inflation and rates of interest in most particular person international locations.

This web page additionally tracks measures which can be carefully monitored for indicators of how inflation and coverage charges would possibly evolve within the months forward.

The newest figures for the world’s largest economies present that inflation stays elevated in some international locations, excluding meals and power, a key measure of underlying worth pressures.

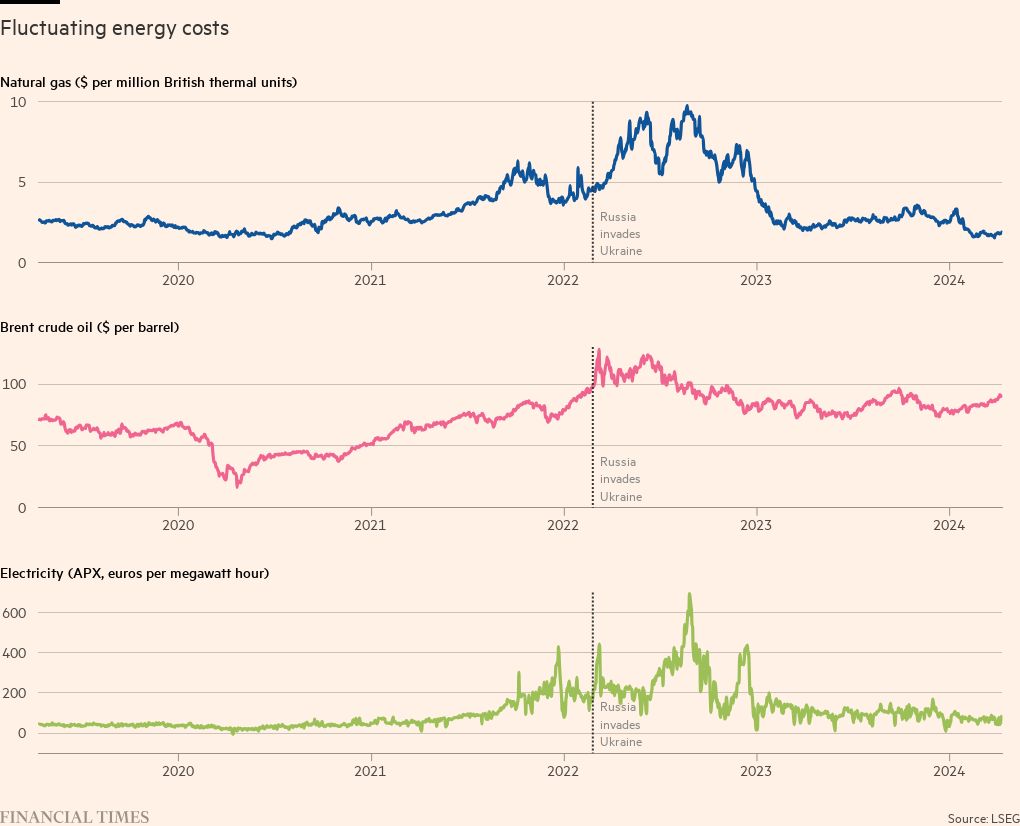

Wholesale power prices present a well timed measure of the value pressures customers would possibly face within the coming months.

An increase in power costs was the principle driver of inflation in lots of international locations in recent times, however gasoline and electrical energy prices have now retreated from their peaks through the power disaster that emerged after Russia invaded Ukraine.

This web page additionally tracks the yields on 2-year authorities bond yields, that are strongly affected by market expectations of rates of interest over that point.

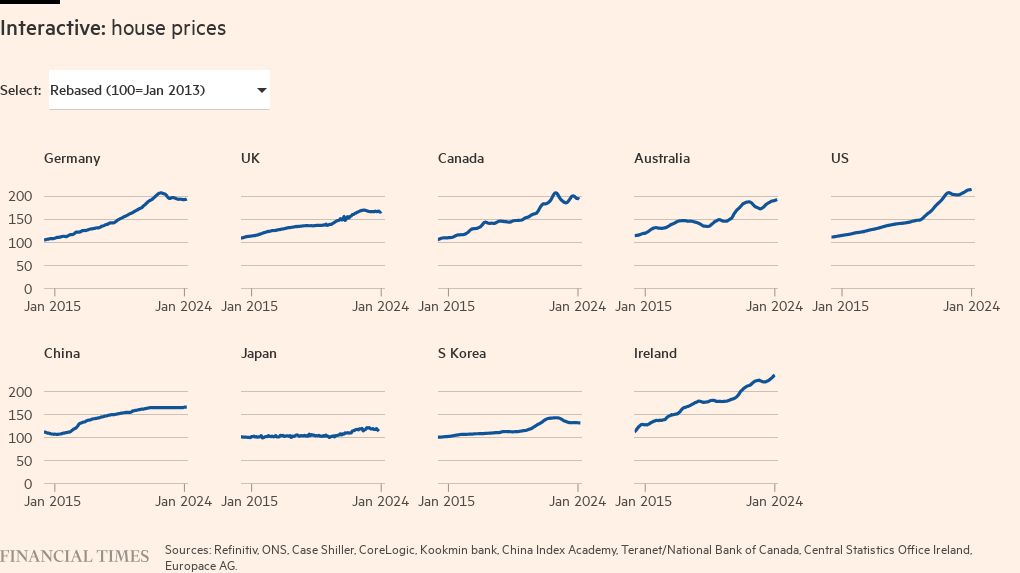

Asset costs have been one other level of concern, particularly for homes. The value of houses soared in lots of international locations through the pandemic, however excessive mortgage charges have led to a major slowdown in home worth development in numerous international locations.

MoneyMaker FX EA Trading Robot

powered by qhost365.com

Ft.com