Article content material

(Bloomberg) — Trimet Aluminium SE will ramp up manufacturing at its smelters in France and Germany to full capability within the coming 12 months, in an indication that falling power costs are serving to to convey the European aluminum trade again from the brink of an existential disaster.

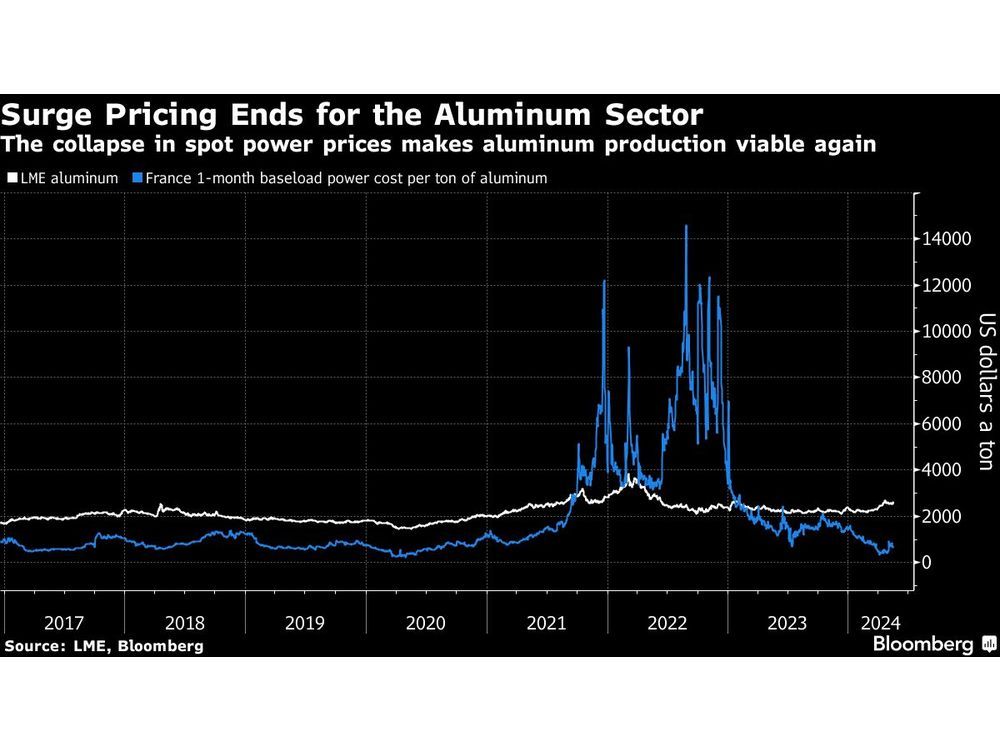

The continent’s aluminum sector was one of many worst-affected industries throughout the power disaster, with greater than half of regional capability taken offline as energy costs surged. The metallic is among the most energy-intensive to provide, and on the peak of the disaster the spot price of shopping for the ability wanted to make aluminum in nations like France was greater than 5 instances increased than the worth that smelters might gather promoting metallic.

Article content material

Now, the fee would account for a few quarter of the worth, in keeping with Bloomberg calculations based mostly on spot costs and the standard quantity of energy wanted to provide aluminum — which is about 40 instances increased than is required to make copper.

Trimet — which has been operating its vegetation in Germany and France at lower than 50% of capability over the previous two years — mentioned on Thursday it plans to ramp as much as full capability by mid-2025, focusing on output of 540,000 tons per 12 months. It secured a long-term energy provide contract for its French plans with EDF final 12 months, it mentioned.

“Relaxed conditions in procurement markets and, notably, decreased electricity prices have now made it economically viable to produce aluminum again,” the corporate, which is headquartered in Essen, Germany, mentioned in a press release.

Power costs have retreated sharply from the highs seen throughout the worst power disaster in a long time. Benchmark German energy has fallen 32% up to now 12 months and are near the five-year common. That coupled with stronger financial information from Germany is creating some optimism that power demand will return.

Article content material

Some aluminum smelters who’re much less uncovered to identify energy costs have already restarted capability, and there have additionally been restarts in industries together with zinc and metal. But the large quantities of energy wanted by the aluminum sector — and heavy prices related to curtailment and closure — have raised worries that regional manufacturing may by no means absolutely get well.

Aluminum costs fell 1% to $2,571.50 a ton the London Metal Exchange after the announcement, reversing earlier beneficial properties. Prices of the metallic have rallied greater than 8% this 12 months because the outlook for demand begins to brighten following deep contractions in areas like development.

—With help from Rachel Morison.

Share this text in your social community

MoneyMaker FX EA Trading Robot

powered by qhost365.com

Financialpost.com