Speculation over fee cuts is reaching an all-time excessive, and traders are intently monitoring the Federal Reserve’s actions. While the precise timing and variety of fee cuts stay unsure, it is broadly anticipated that the Fed will ultimately scale back charges to take care of financial stability.

As we strategy this potential catalyst, I’ll discover how traders can finest place themselves out there.

The small-cap progress dilemma

Small-cap progress shares have confronted challenges because of excessive rates of interest. Many of those firms depend on debt devices for financing, which turns into costlier when charges rise.

Consequently, some small-cap shares are presently buying and selling at destructive enterprise values — a uncommon prevalence. While predicting how these shares will reply to fee cuts is tough, one doubtless final result is a broad rally inside this phase of equities.

Identifying potential winners

Here are 4 small-cap worth shares that might rebound sharply in response to fee cuts later in 2024 or early 2025. For this text, I outline small-cap shares as these with market capitalizations underneath $6 billion (a barely totally different criterion than the textbook definition, however one utilized by top-tier indices just like the CRSP US Small Cap Value index).

Four small-cap progress shares to look at

1. Archer Aviation

Archer Aviation (NYSE: ACHR) is targeted on electrical vertical takeoff and touchdown (eVTOL) plane. As city air mobility good points traction, Archer’s progressive know-how might place it for vital progress.

Its inventory is down 37% yr so far. However, the corporate is staring down a number of main catalysts that might set off a rebound quickly.

2. Joby Aviation

Joby Aviation (NYSE: JOBY) is one other eVTOL participant. With a deal with air taxi companies, the corporate goals to revolutionize short-distance journey. Rate cuts might increase investor confidence on this sector, and as one of many best-capitalized gamers within the house, Joby stands out as an intriguing speculative purchase.

More particularly, Joby is racing towards a possible trillion-dollar business alternative. The eVTOL market is anticipated to be exceedingly aggressive, however Joby is likely one of the frontrunners that might be among the many first to market.

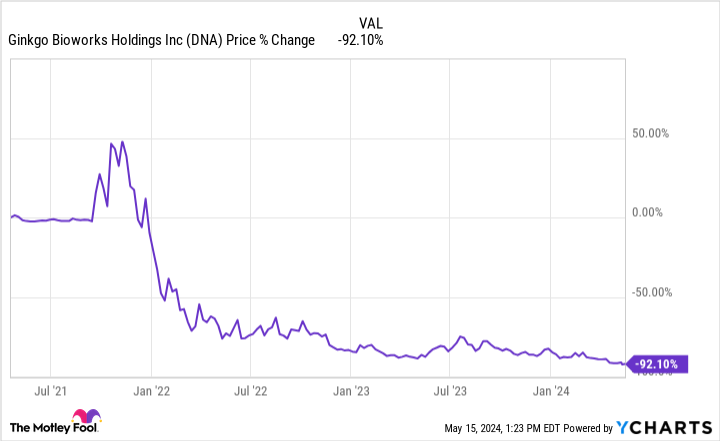

3. Ginkgo Bioworks

Ginkgo Bioworks (NYSE: DNA) makes a speciality of artificial biology and genetic engineering. As biotech rebounds in anticipation of a pleasant capital-raising setting, Ginkgo’s distinctive strategy to creating customized organisms might repay massive for affected person shareholders. That stated, Ginkgo’s shares have misplaced 92% of their worth since their public debut, underscoring the high-risk nature of this rising biotechnology platform.

4. Iovance Therapeutics

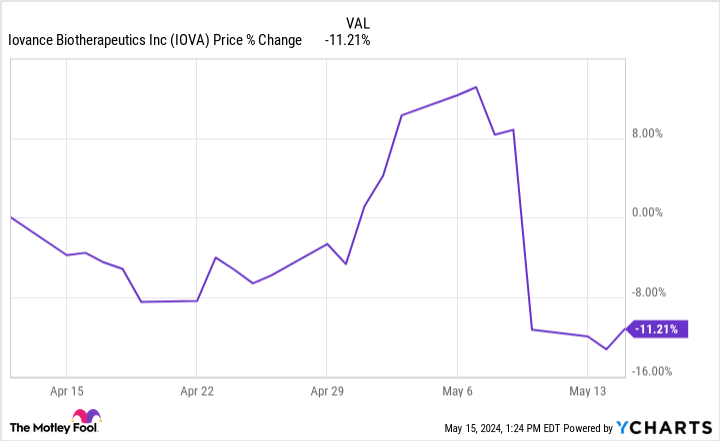

Iovance Therapeutics (NASDAQ: IOVA) focuses on most cancers immunotherapies, with a particular emphasis on tumor-infiltrating lymphocyte therapies. Earlier this yr, Iovance received a landmark regulatory approval from the Food and Drug Administration for Amtagvi as a remedy for sure types of superior melanoma.

As novel therapies usually take just a few years to ramp up, some traders have moved to the sidelines following this regulatory approval. To wit: Iovance’s shares are down about 11% over the previous 30 days. An enhancing financing panorama and rising Amtagvi gross sales might spark a turnaround.

Final ideas

While no funding is risk-free, these small-cap worth shares provide intriguing alternatives. However, traders ought to think about the knowledge of shopping for baskets of those shares or perhaps a thematic exchange-traded fund (ETF) within the small-cap progress or worth panorama.

After all, small caps are identified for his or her excessive volatility at instances. Moreover, particular person small caps can underperform for lengthy intervals, which may weigh in your portfolio’s annual efficiency.

Should you make investments $1,000 in Archer Aviation proper now?

Before you purchase inventory in Archer Aviation, think about this:

The Motley Fool Stock Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Archer Aviation wasn’t certainly one of them. The 10 shares that made the minimize might produce monster returns within the coming years.

Consider when Nvidia made this record on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $559,743!*

Stock Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Stock Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

George Budwell has positions in Archer Aviation. The Motley Fool has positions in and recommends Iovance Biotherapeutics. The Motley Fool has a disclosure coverage.

4 Small-Cap Value Stocks That Could Go Parabolic was initially printed by The Motley Fool

MoneyMaker FX EA Trading Robot

powered by qhost365.com

Finance.yahoo.com